The cryptocurrency market is growing fast, attracting more investors. More people are exploring lesser-known crypto exchanges. They seek unique features, low fees, and a variety of digital assets. One of these new platforms is LBank, a crypto trading exchange known for its diverse trading pairs and innovative products.

In this LBank review, we’ll cover its main features, security measures, ease of use, and overall performance. This will help you decide if it meets your trading needs.

Table of Contents

LBank Review At a Glance

- Supported Coins: 610+ tokens and 800+ trading pairs

- Trading Fees: 0.1% maker/taker

- Maximum Leverage: 125x

- Security: 2FA, Cold Storage, SSL, and more

- Fiat Currencies: 50+ including USD, EUR, GBP, CAD, AUD, INR, AED, etc.

- Deposit Methods: Master Card, Visa, Google Play, ApplePay, Bank Transfer, etc.

LBank Exchange is a global cryptocurrency trading platform founded in 2015. It has grown to serve over 7 million users from more than 210 countries. The exchange offers trading for 610+ digital assets across 800+ trading pairs. LBank’s daily trading volume often exceeds $1 billion, making it one of the top 20 exchanges by volume (Source: CoinMarketCap).

The platform provides spot trading, derivatives, and staking services. It supports various payment methods, including bank transfers and credit cards. LBank’s user-friendly interface caters to both beginners and experienced traders.

LBank has its own token, LBK, which offers benefits like reduced trading fees and participation in new token listings. The exchange also runs a referral program, allowing users to earn up to 40% commission on their referrals’ trading fees.

In terms of regulation, LBank has obtained licenses in several jurisdictions, including Estonia and the United States.

Pros

- Many cryptocurrencies including BTC, ETH, and USDT

- Supports 50 fiat currencies via credit/debit cards

- Advanced trading features like P2P, futures, grid trading, and leveraged tokens

- Copy Trading for beginners

- East to use Mobile App for Android and iOS devices

Cons

- Lower Liquidity on small altcoins

- No Margin Trading

- Moderate Security Rating by Experts

- Not Available in the U.S

LBank Crypto Exchange Overview

| Key Information | Details |

|---|---|

| Our Rating | 4/5 |

| Founded | 2015 |

| Headquarters | Hong Kong |

| Supported Cryptocurrencies | 610+ |

| Trading Options | Spot, Futures, Leveraged Tokens |

| Fiat Support | Yes (through P2P and fiat-to-crypto channels) |

| Languages Supported | Multiple, including English, Chinese, Korean, Japanese |

| Security Measures | Two-Factor Authentication (2FA), Cold Storage, SSL |

| Regulatory Compliance | Registered and licensed in multiple countries, including the US, Canada, Australia |

| Mobile App | Available for iOS and Android |

| Customer Support | 24/7 support through email, live chat, and social media |

| Funding Methods | Master Card, Visa, Google Play, ApplePay, Bank Transfer, Simplex, Banxa, etc |

| Withdrawal Methods | Cryptocurrency withdrawals and third-party payment processors |

| Staking | Yes |

| Copy Trading | Yes |

| API Access | Yes, for automated trading and integration |

| Trading Fees | Spot Fees: 0.1% maker/taker Leveraged Tokesn Fees: 0.2% maker/taker Futures Fees: 0.02% maker and 0.06% taker |

| Security Rating | 77/100 (according to CER.live) |

What We Like: LBank Platform Pros

Instant Fiat-to-Crypto Channels

1. Credit and Debit Card

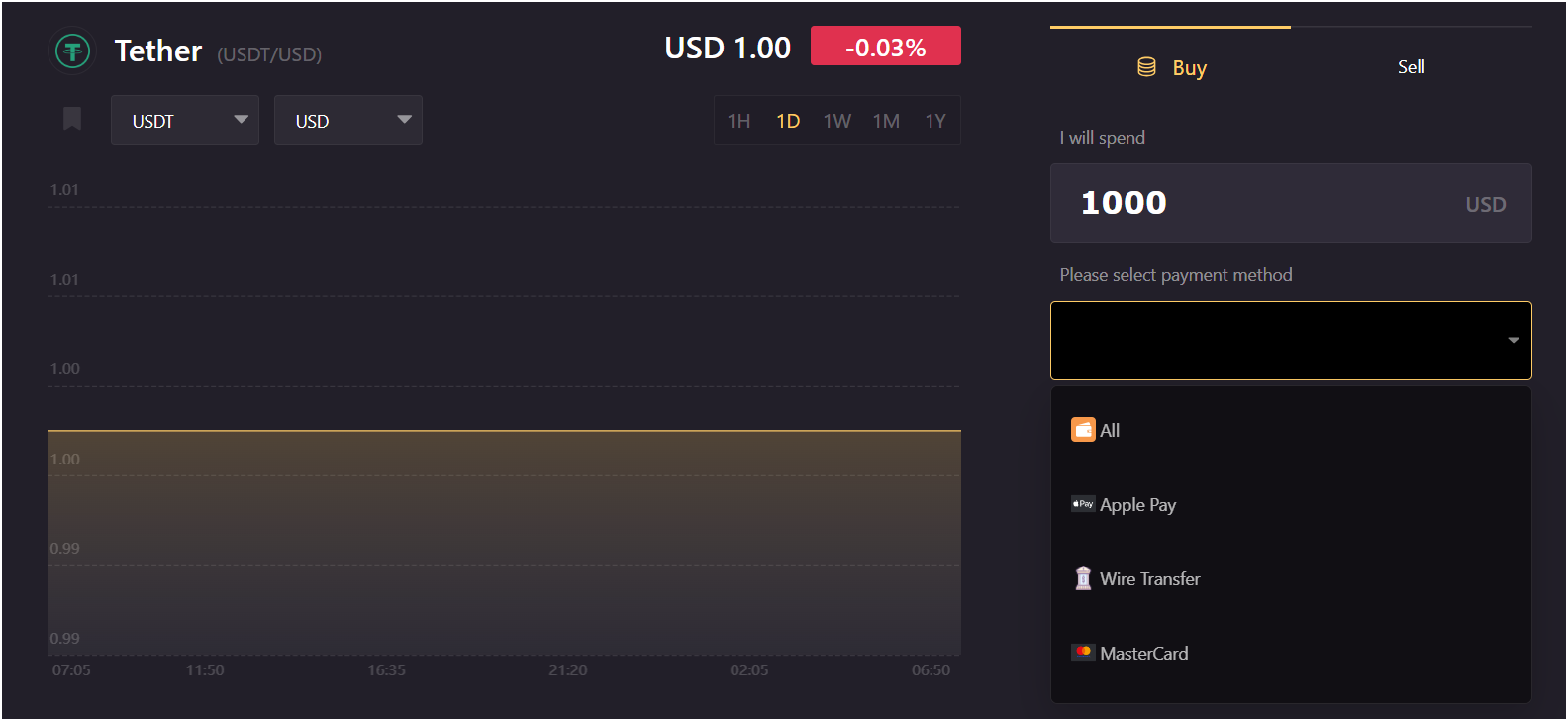

LBank makes buying and selling cryptocurrencies easy. It supports credit and debit card transactions. The platform works with almost 50 fiat currencies, so users from many regions can use it.

You can buy popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT) using Visa or Mastercard. LBank also connects with third-party payment gateways. This allows transactions using Apple Pay, Google Pay, and Volet.com.

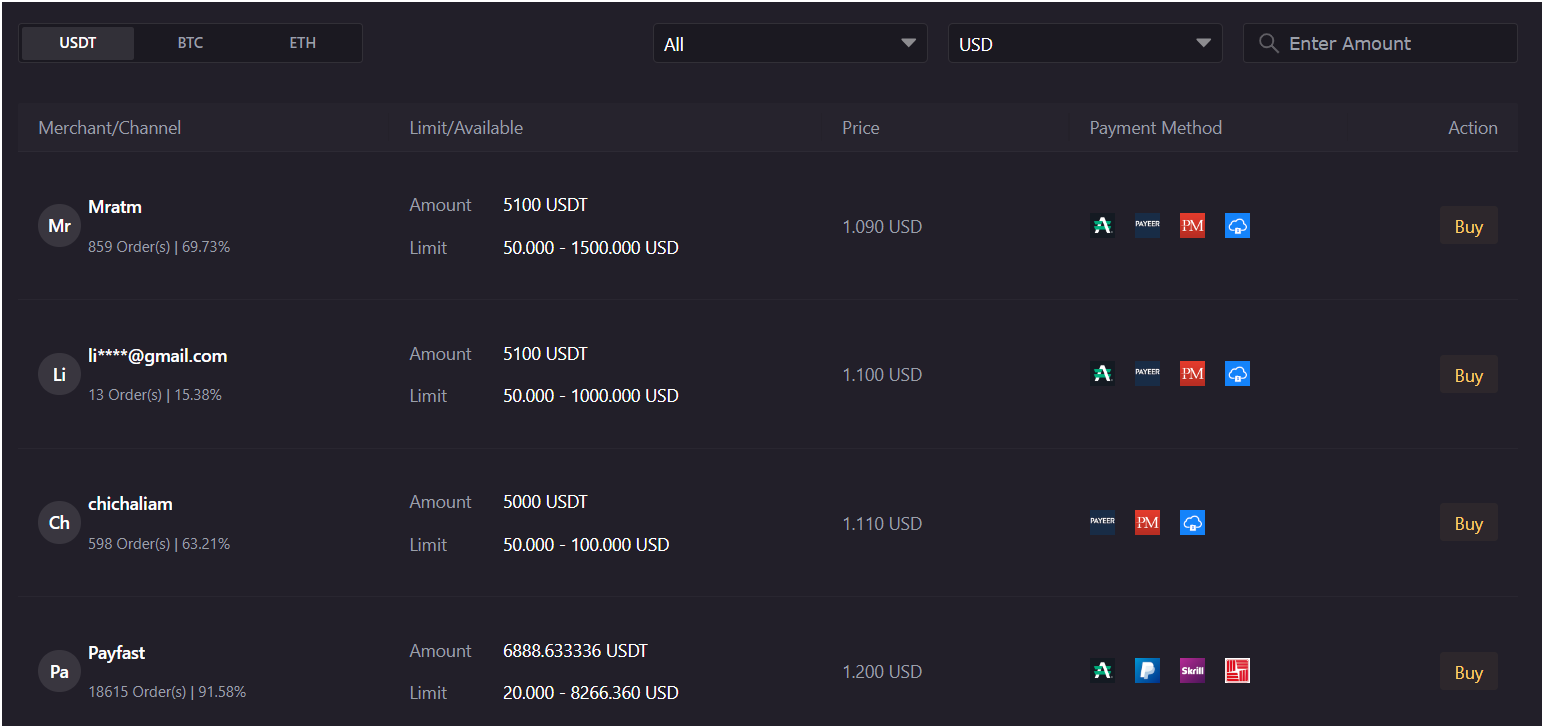

2. P2P Trading

LBank’s P2P trading feature connects buyers and sellers directly. This setup eliminates the exchange’s role in monetary transfers. Users can easily post offers to buy or sell cryptocurrencies. Others can respond and complete transactions.

P2P trading supports cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT). The platform also accepts many fiat currencies, including USD, EUR, and GBP. Traders worldwide can choose from over 50 options. They can use their local currency for easy transactions.

LBank’s P2P marketplace supports over 20 payment methods. This gives users flexibility and ease when making transactions. Major options are MasterCard, Visa, Google Pay, Apple Pay, and bank transfers.

Futures Trading

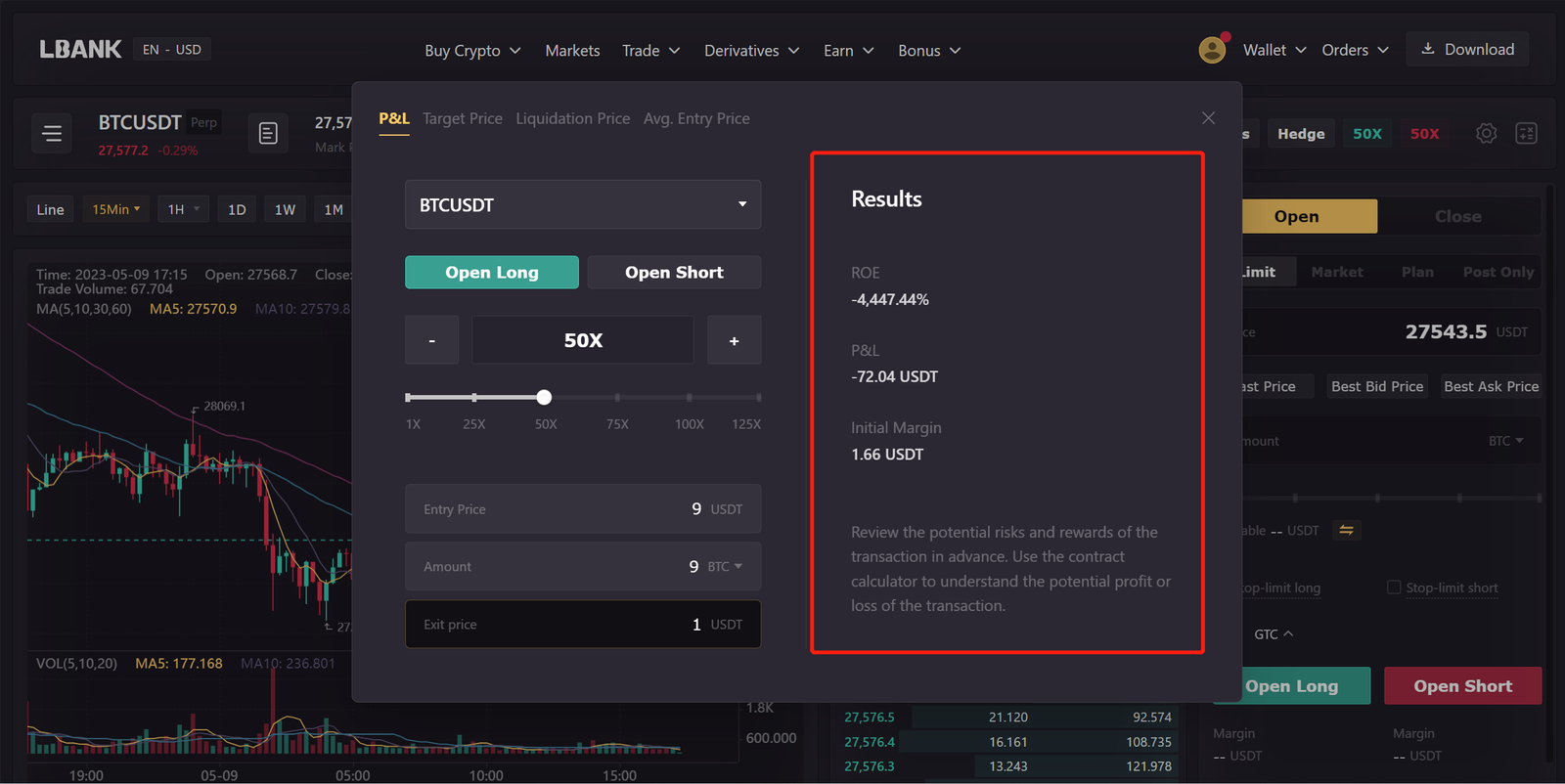

LBank has a futures trading platform. It allows users to guess cryptocurrency prices without actually owning the coins. Futures trading means agreeing to buy or sell cryptocurrencies at a set price on a future date. This is different from trading the cryptocurrencies directly.

- On LBank, all futures contracts settle in USDT. This ensures that profits and losses are calculated and paid in a stable currency. These are called USDT-M futures. LBank does not provide Coin-M futures, where settlements happen in the actual cryptocurrencies.

- LBank also specializes in perpetual contracts, known as “perps.” These contracts have no expiry or settlement date. Traders can hold positions indefinitely without the limits of traditional futures contracts.

To manage risk well, LBank offers two margin modes:

- Cross-Margin Mode: All futures positions share the same margin balance. Losses in one position can use the margin from others to avoid liquidation.

- Isolated-Margin Mode: Each position works independently with a specific margin for every trade. This limits losses on each trade. However, you might need more margin for several positions.

Leverage is a key feature of LBank’s futures trading. It lets users control large positions with smaller investments:

- For popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), leverage can reach 125x. This means users can control $12,500 worth of crypto with just $100.

- For less popular cryptocurrencies, the maximum leverage is usually capped at 20x. This offers a balanced approach to risk and reward.

LBank’s futures trading platform includes perpetual contracts, smart risk management tools, and flexible leverage options. This helps traders confidently navigate the changing cryptocurrency market.

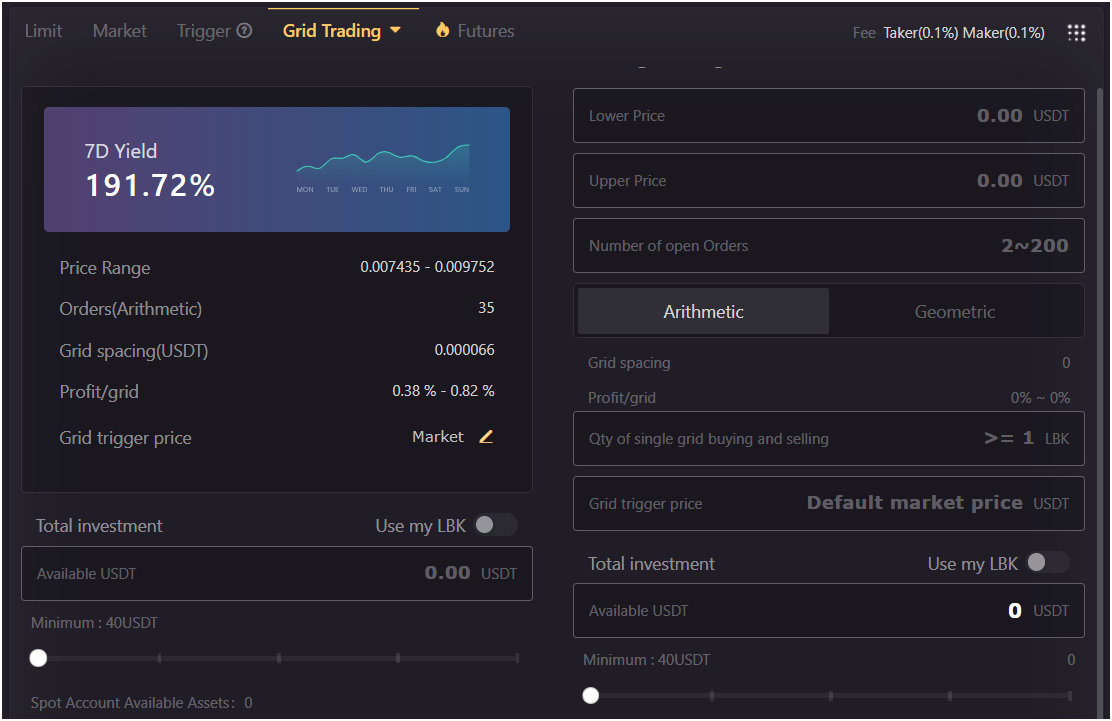

Grid Trading

Grid trading is a strategy that takes advantage of price swings within a set range. It works by buying low and selling high. The system automatically places buy orders at lower prices and sell orders at higher prices. When the market hits a buy level, it buys a specific amount of cryptocurrency. When it reaches a sell level, it sells the predetermined amount.

Key components of LBank’s Grid Trading system include:

- Price Range: Users set upper and lower limits for the trading grid. This defines the range the system will work within.

- Grid Levels: The price range is split into several equal levels, forming the grid structure.

- Order Placement: Buy orders are placed at grid levels below the current market price. Sell orders go at levels above it.

- Order Execution: As the market price moves, it triggers these preset buy and sell orders.

- Position Rebalancing: When a buy order completes, a sell order is placed at a higher grid level, and vice versa. This keeps trading ongoing.

- Profit Mechanism: The system makes money from the price gaps between buy and sell orders. This happens as the market changes within the grid range.

LBank’s Grid Trading system provides an automated way for traders to profit from market volatility. It simplifies earning from small, frequent price movements.

Leveraged Tokens

LBank offers leveraged tokens. These are unique derivative products. They let traders have more exposure to changes in cryptocurrency prices. Traders can use these tokens for leverage. They don’t have to worry about collateral, margin, or liquidation risks. They maintain a fixed leverage level, usually 2x, 3x, or more. This means the token’s price changes in line with the underlying asset.

For example, a Bitcoin leveraged token with 3x leverage, called BTC3L, would rise by 3% if Bitcoin’s price goes up by 1%. On the other hand, if Bitcoin’s price drops by 1%, BTC3L would fall by 3%.

Leveraged tokens are made for short-term trading. They are rebalanced daily to keep their target leverage ratio. This daily adjustment can impact performance, especially during high volatility or when held for long periods. Compounding effects may cause the actual leverage ratio to differ from expectations.

Copy Trading

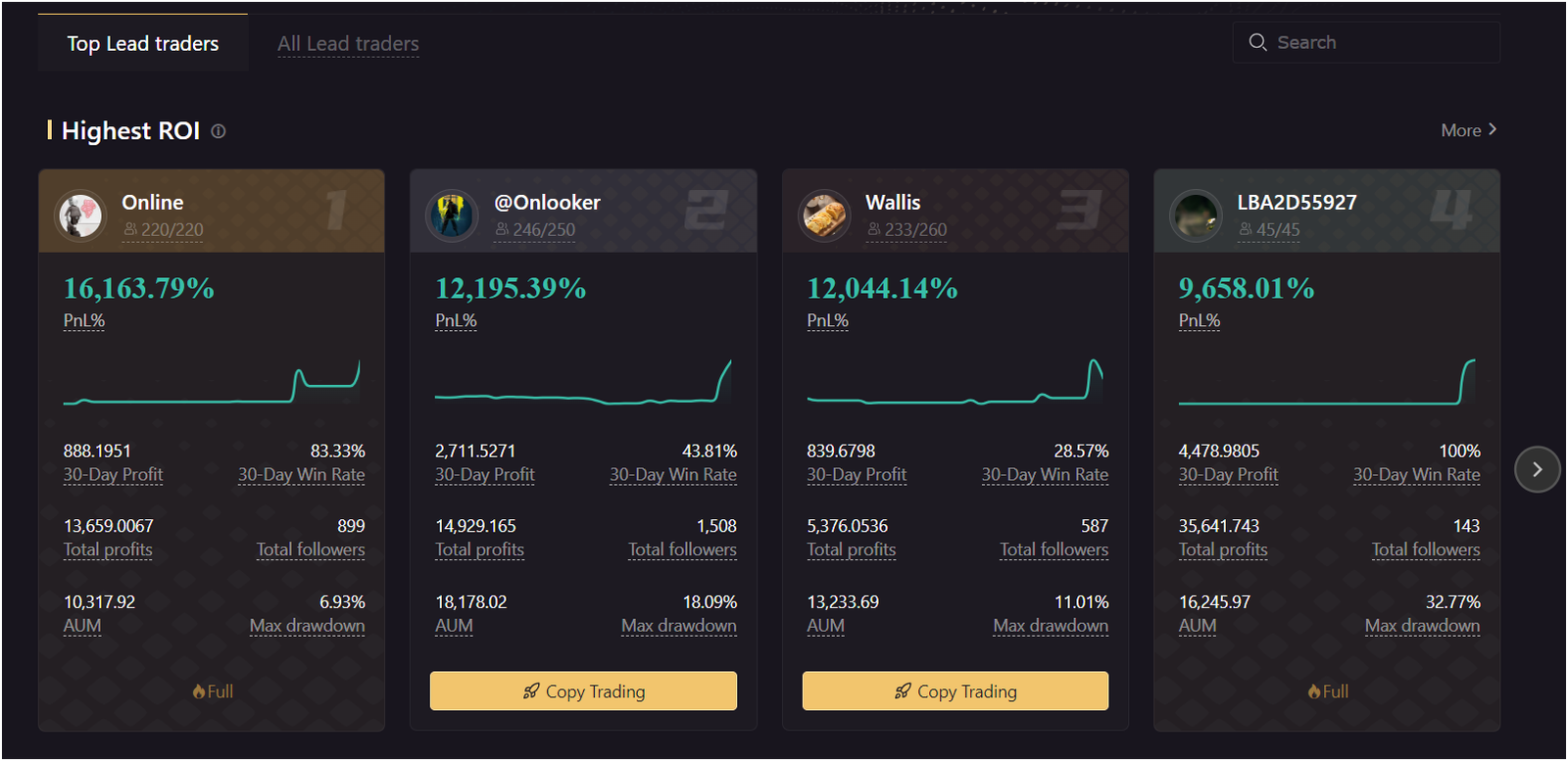

LBank’s Copy Trading feature lets users follow skilled traders, called “lead traders.” You can benefit from their success without needing advanced skills.

To start with copy trading on LBank, check out the list of lead traders. Each trader’s profile shows key metrics like ROI (Return on Investment), win rate, risk level, and trading history. These details help you assess a trader’s performance and find a style that fits your goals.

After picking a lead trader, you can set aside some funds to copy their trades. The system will then carry out trades in your account based on what the lead trader does. For example, if the lead trader opens a position, a similar position opens in your account, scaled to your funds.

LBank also offers customization options for your copy trading experience. You can set stop-loss limits to manage risk. Adjust the copy ratio to decide how closely you follow the trader. You can also choose specific types of trades to replicate.

The platform usually works on a profit-sharing model. Lead traders earn a share of the profits from their copiers, often up to 15%. This encourages lead traders to do well and attract more followers. As a copier, you keep full control of your funds and can stop copying a trader anytime.

Earn Passive Income on Idle Crypto

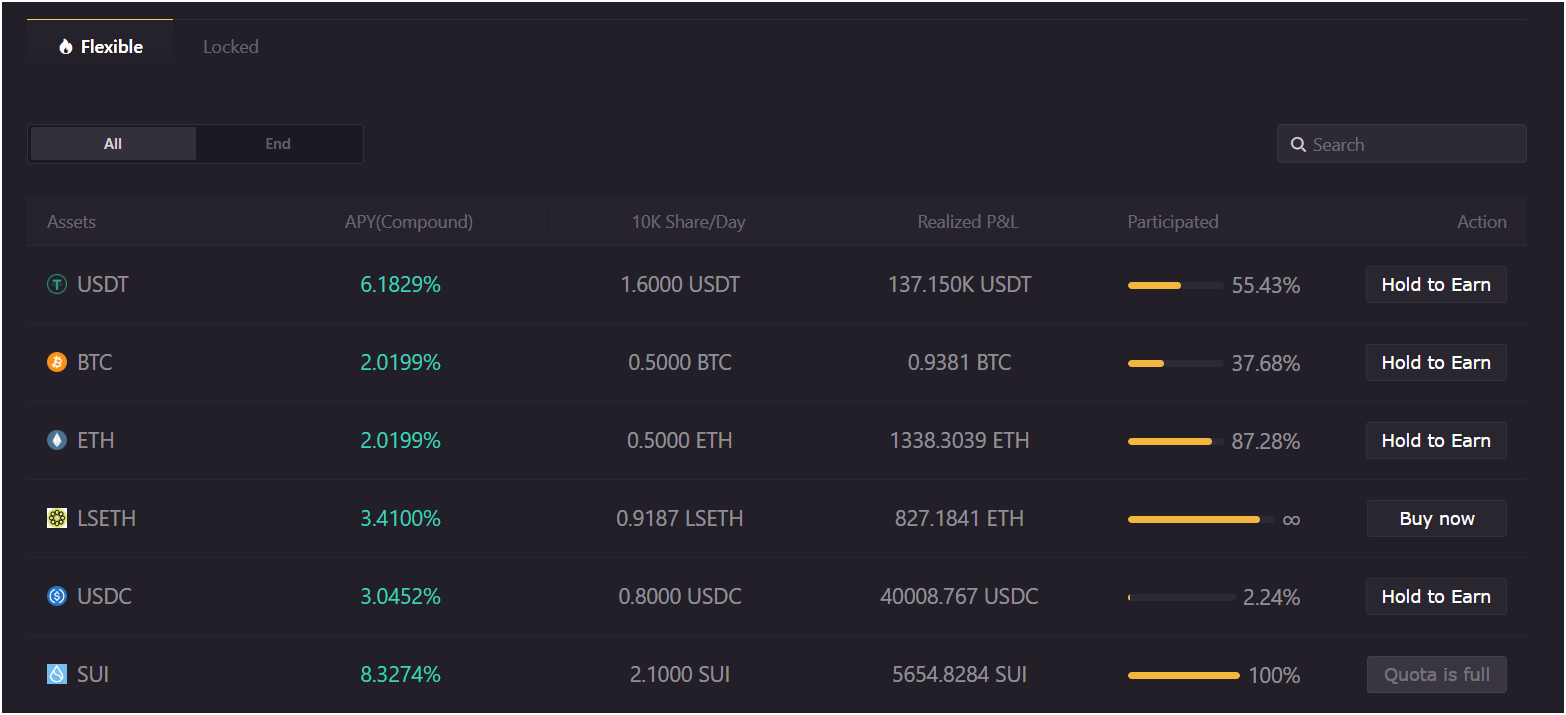

LBank Earn offers users ways to earn passive income from their crypto holdings. The platform is user-friendly. It has features for various preferences and investment strategies.

Flexible and Locked Staking

Flexible staking allows you to earn interest on your cryptocurrency while keeping the option to withdraw anytime. APYs for flexible staking usually range from 1% to 5%, depending on the cryptocurrency.

Locked staking offers higher returns since it requires you to commit your funds for a set time. For example:

- A 30-day BTC staking plan may provide 4-6% APY.

- A 90-day ETH staking plan might yield 5-8% APY.

- Some altcoins can offer much higher returns, with APYs up to 50% for longer lock-up periods.

Crypto Loans

LBank lets users use their cryptocurrency as collateral to borrow other cryptocurrencies or stablecoins. The Loan-to-Value (LTV) ratios usually range from 50% to 75%. This flexibility depends on the value of the collateral.

Interest rates for borrowing on LBank can vary widely. They often range from 3% to 12% Annual Percentage Rate (APR). These rates depend on market conditions and the specific cryptocurrencies involved.

Launchpad

LBank’s Launchpad gives users early access to upcoming token sales. This lets them invest in new projects before they hit the wider market. While it’s not a direct earning option, it can lead to significant returns if the projects succeed after launch.

To participate, users usually need to hold a certain amount of USDT. Details like token price, allocation, and other conditions differ by project. This ensures each launch meets its specific goals and requirements.

LBank Card

The LBank Card is a crypto debit card. It lets you spend your crypto assets on everyday purchases. It may not directly earn rewards, but it provides convenience and may offer cashback. Typical cashback rates for crypto cards are between 1% and 3%.

What We Don’t Like: LBank Cons Reviewed

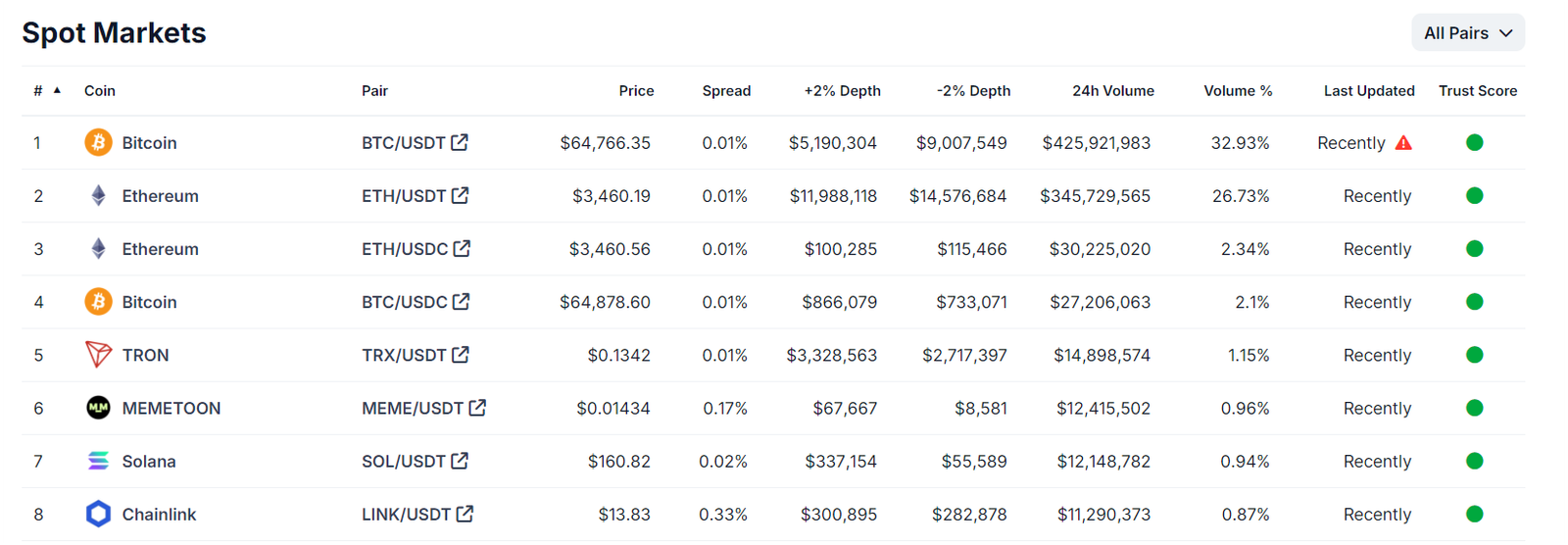

Lower Liquidity

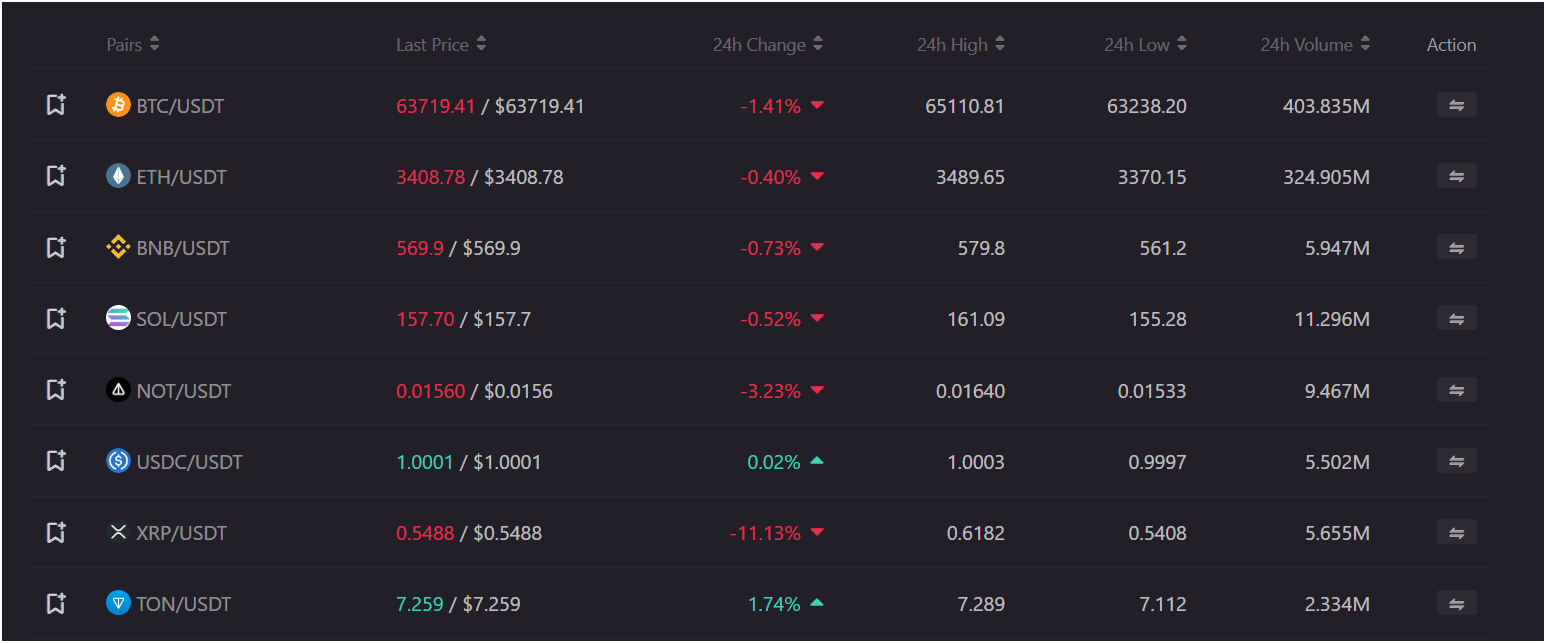

Liquidity is the ease of buying or selling assets without causing big price changes. At LBank, lower liquidity means fewer buyers and sellers, especially for low-cap altcoins. Most trading volume comes from BTC and ETH.

According toCoingecko, over 60% of trading volume involves pairs like BTC/USDT, ETH/USDT, ETH/USDC, and BTC/USDC.

Executing a large trade can cause slippage. This happens when the price changes while your order is being filled. It’s common with less popular cryptocurrencies or high-volume trades. This makes trading a big challenge in these situations.

Low liquidity adds to the problem. It can cause delays in order execution, leading to missed chances. In volatile markets, traders may struggle to exit positions quickly. This can increase their risk of losses.

No Margin Trading

Margin trading is a key feature on major exchanges like Binance and Bybit. It lets users borrow funds to boost their trading positions. LBank’s lack of this service limits its appeal, especially to high-volume and day traders.

Without margin trading, LBank struggles to attract higher trading volumes. Traders using margin usually seek platforms that allow bigger trades and higher profits.

Lower Security Rating

LBank’s security rating shows some areas of concern. CER.live, a trusted site for crypto exchange assessments, gives LBank a BBB rating and a security score of 77%. This rating puts LBank in the middle tier. It means LBank has some security measures, but there’s still room to improve.

Certik, a well-known blockchain security firm, offers a similar score of 77.83%. These ratings show that LBank has some security protocols in place but does not meet the highest industry standards.

It’s important to note that LBank has not faced any major security breaches so far. While this is a positive sign, it does not guarantee future safety.

No U.S. Availability

LBank Exchange has a big limitation: it’s not available in the United States. The U.S. is a major market for cryptocurrency trading, with many retail and institutional investors.

This issue likely stems from the complex U.S. regulations. Crypto exchanges must follow various federal and state laws. They need to register with FinCEN as a Money Services Business and get money transmitter licenses in multiple states.

Not being in the U.S. limits LBank’s growth and competitiveness worldwide. Many traders prefer exchanges that serve a global audience, leading to better liquidity and more trading pairs.

The lack of U.S. availability may worry some about LBank’s ability to follow strict rules. This issue might discourage U.S. traders. It could also make users in other areas doubt the exchange’s commitment to following regulations.

What are LBank Fees?

| Type of Trading | Maker Fee | Taker Fee |

|---|---|---|

| Spot Trading Fees | 0.1% | 0.1% |

| Leveraged Tokens Fees | 0.2% | 0.2% |

| Futures Fees | 0.02% | 0.06% |

LBank has different trading fees for various transaction types. For spot trading, the maker and taker fees are both 0.1%. Leveraged token trading has higher fees, with rates at 0.2% for both maker and taker. Futures trading offers lower fees: a maker fee of 0.02% and a taker fee of 0.06%.

Deposits for cryptocurrencies are free. This makes transferring assets to the platform easy. Withdrawal fees depend on the blockchain network used, but internal transfers within LBank have no fees. For the latest withdrawal rates, users should check LBank’s platform directly.

Security Measures: Is LBank Safe?

In our LBank review, we rate its security an 8/10. Here’s why.

LBank Exchange isn’t the top choice for security, but it has important measures to protect user funds and data. It has a good track record with no major breaches reported. However, safety should be viewed with balance.

- LBank offers various 2FA methods, like Google Authenticator and SMS verification. Users can pick the option that fits them best.

- For fund storage, LBank uses cold storage for a large part of user assets. Cold storage means keeping cryptocurrencies offline, often in hardware wallets or air-gapped computers. This lowers the risk of hacking and unauthorized access. The exact amount in cold storage isn’t shared, but this method is a common best practice.

- LBank also uses standard encryption protocols to safeguard user data. This includes SSL (Secure Socket Layer) encryption for data sent between users’ devices and the exchange’s servers. This encryption helps stop man-in-the-middle attacks and keeps sensitive information safe during transit.

- Proof of reserves lets users check that the exchange has enough assets to cover all customer deposits. This builds trust and accountability. LBank provides transparent PoR data.

LBank’s safety rating is in the mid-tier category, according to trusted platforms like CER.live and Certik. It scores between 77% and 78%, showing its commitment to security measures. However, it has not yet met the highest industry standards. This leaves room for improvements.

LBank Review: Regulatory Licenses

- USA: LBank has a Money Services Business (MSB) certification from FinCEN. This lets it provide financial services under U.S. regulations.

- Canada: The exchange is registered with FINTRAC, Canada’s financial intelligence agency. This shows it follows Canadian financial rules.

- Italy: LBank holds a Virtual Asset Service Provider (VASP) permit. This allows it to offer crypto services in line with Italian laws.

- Australia: LBank is recognized by AUSTRAC, Australia’s financial intelligence agency. It is registered as a remittance service provider and a digital currency exchange, ensuring it operates legally in Australia.

- Lithuania: LBank is registered under Lithuanian law. This lets it function as a cryptocurrency exchange. It also offers digital wallet services and other virtual asset options.

LBank Review: Alternatives and Comparison

According to our LBank review, we will consider Bitget and KuCoin as the top alternative to the LBank crypto exchange. Here is a quick comparison between LBank vs KuCoin and LBank vs Bitget:

Bitget (Best For Crypto Copy Trading)

- Top Features: Spot, Futures with 125x leverage, Trading bots, and Copy trading

- Supported Coins: 850+ including low-cap altcoins

- Trading Fees: 0.1% maker/taker

- Deposit methods: Bank transfer, debit/credit card, P2P marketplace

KuCoin (Best For New Altcoin Trading)

- Top Features: Spot, Futures, Margin, Trading bots, and P2P Trading

- Supported Coins: 700+ including new altcoins

- Trading Fees: 0.1% maker/taker

- Deposit methods: Visa, Mastercard, SEPA, UPI, Faster Payment System (FPS), and 70+ more

How to Use LBank Crypto Exchange?

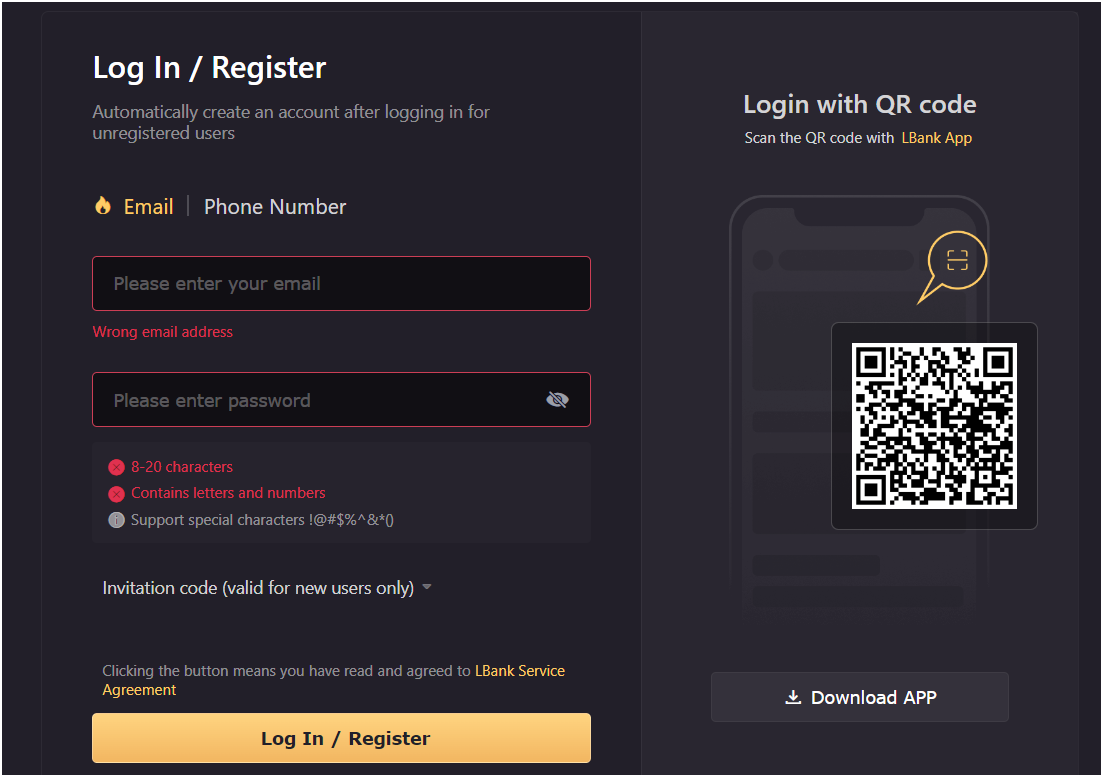

To use LBank Crypto Exchange, follow these simple steps. This guide covers creating an account, depositing crypto, and starting your trading journey. Here’s how to get started with LBank:

Step 1: Create an Account on LBank

To start with LBank, go to their official website. Find the “Sign Up” button to begin registration. Enter your email address, create a secure password, and submit the information. You will receive a verification email. Click the link in the email to activate your account.

After activation, complete the KYC (Know Your Customer) verification to access all features. Log in and go to the “User Center.” Then, select “KYC Verification.” Fill in your full name, date of birth, and address. Upload a government-issued ID and a selfie holding the ID for identity confirmation.

The KYC process may take a few hours or several days. Once approved, you will have full access to LBank’s services.

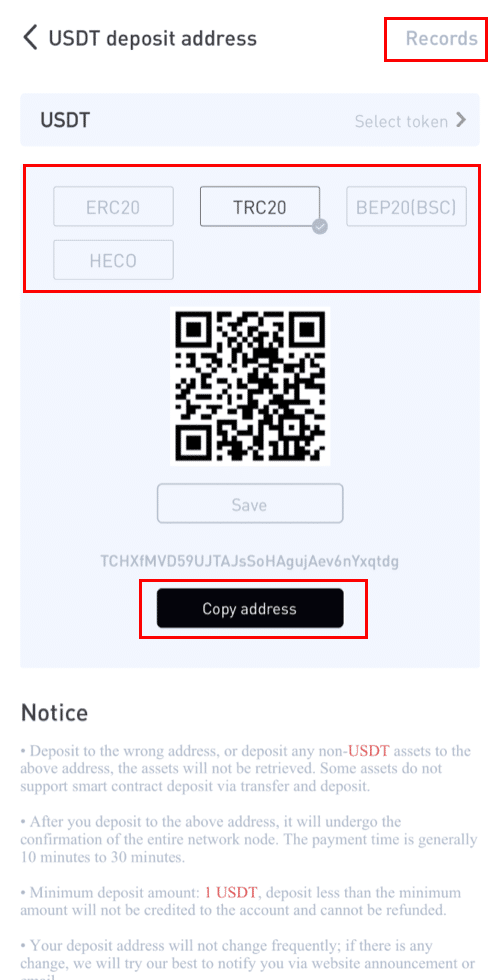

Step 2: Deposit Crypto on LBank

To deposit cryptocurrency on LBank, log into your account. Go to the “Assets” section. Click on “Deposit” and select the cryptocurrency you want to deposit. LBank will create a unique wallet address for that cryptocurrency. Copy this address. Paste it into the wallet or exchange where your funds are stored to start the transfer.

Step 3: Start Trading Crypto

Once you have cryptocurrency in your LBank account, you can start trading. Go to the “Trade” section. Here, you’ll see various trading pairs like BTC/USDT and ETH/USDT. Select the pair you want. The trading interface shows key tools, such as a price chart, order book, and trade history. These help you make informed decisions.

When you trade on LBank, you can choose a market order or a limit order. A market order is filled right away at the current price. With a limit order, you set the price for buying or selling. After entering the amount and price for limit orders, click “Buy” or “Sell.” Once your order goes through, you’ll get a confirmation. You can easily check your open orders and trade history in the “Order” section of the platform.

Final Verdict

This review shows the pros and cons of LBank as a cryptocurrency exchange. The platform offers a range of trading pairs, quick fiat-to-crypto conversions, and various trading options like P2P and futures trading. Security features, including two-factor authentication (2FA) and cold storage, help protect users.

However, lower liquidity and the absence of margin trading might turn away some traders. Also, the exchange is not available in the U.S., which limits its global appeal.

Still, LBank is a strong option for traders seeking low fees and innovative features to improve their trading experience.

FAQs on LBank Exchange Review

What is LBank?

LBank is a complete cryptocurrency trading platform. It supports many digital assets. Users can engage in spot trading and futures trading. The platform also provides various financial products for cryptocurrency enthusiasts and traders.

How reliable is LBank?

LBank is seen as a reliable cryptocurrency exchange. It has a strong track record of protecting user assets and delivering full trading services. Its security features include two-factor authentication (2FA) and cold storage for most user funds. These measures help build trust with clients. Also, LBank has obtained licenses and registrations in various regions. This shows its commitment to following regulations and ensuring transparency.

Is LBank a Chinese exchange?

LBank started in China but now operates globally. It is headquartered in Hong Kong. The exchange serves users from many countries and meets international regulations. LBank is present in several markets, like Southeast Asia, Europe, and North America.

Can you cash out on LBank?

Yes, users can cash out their funds on LBank. The exchange offers different withdrawal methods. Users can withdraw cryptocurrencies to external wallets. They can also withdraw fiat currency using third-party payment channels. Supported options include Banxa, XanPool, MoonPay, Mercuryo, Simplex, Paxful, and Coinify.

Does LBank require KYC for withdrawal?

Our LBank review shows it uses a tiered Know Your Customer (KYC) system for withdrawals. For lower limits, basic KYC verification is often enough. This usually means providing personal info and a government-issued ID. However, for higher limits or specific fiat withdrawals, LBank may need more KYC steps. This can include proof of address or enhanced verification. The exact KYC requirements depend on the user’s location, withdrawal amount, and regulations.

Is LBank mobile app available?

Yes, LBank has a mobile app for iOS and Android. The app lets you access most features from the web platform. You can view real-time market data, trade, manage your account, and withdraw funds. It aims to provide a smooth and easy trading experience, so you can manage your crypto activities anywhere.