If you’re thinking about investing in Bitcoin or other cryptocurrencies, you might have heard of BYDFi. It was once known as BitYard. This BYDFi review will explore what BYDFi provides. We’ll cover fees, security features, and user-friendliness. We’ll also look at its pros and cons to help you decide if BYDFi suits your needs.

Table of Contents

BYDFi Review At a Glance

- Best For: Derivatives Contract Trading

- Supported Coins: 500+ trading pairs

- Trading Fees: 0.1% maker/taker

- Maximum Leverage: 200x futures contracts

- Fiat Currencies: USD, EUR, CAD, and 60+ more

- Deposit Methods: Electronic payment, cash deposits, Visa/Mastercard credit cards, and debit cards.

BYDFi was established in 2019 and is based in Singapore. It is a cryptocurrency trading platform offering many services. Users can access more than 500 digital assets. They can trade derivatives with 200x leverage. Spot trading is also available, along with copy trading.

The platform aims to make complex cryptocurrency trading tools simple for new investors. For regulatory compliance, BYDFi holds licenses as a Money Service Business (MSB) in Canada and the United States. It is known as a Virtual Asset Service Provider (VASP). It partners with major South Korean crypto exchanges, including Upbit and Bithumb.

Pros

- Competitive spot and futures trading fees

- 500+ supported crypto assets

- 200x leverage for futures contracts

- User-friendly interface with demo trading

Cons

- Lower liquidity and trading volume

- Does not support the U.S. market

- All fiat deposits are handled by third-party payment processors

- No crypto-to-fiat withdrawal methods

- No Phone support

- Does not offer crypto staking services

BYDFi Platform Overview

| Key Points | Details |

|---|---|

| Established | 2017 |

| Headquarters | Singapore |

| Best For | Derivatives Contract Trading |

| Supported Cryptocurrencies | 500+ |

| Fiat Currencies Supported | USD, EUR, CAD, and 60+ more |

| Deposit Methods | Electronic payment, cash deposits, Visa/Mastercard credit cards, and debit cards |

| Regulatory Compliance | Licensed as MSB in Canada and the US |

| Pros | Competitive fees, extensive asset support, high leverage, user-friendly interface |

| Cons | Lower liquidity, not US market supported, no crypto-to-fiat withdrawals, no phone support, no staking services |

| Spot Trading Fees | 0.1% to 0.3% for maker/taker transactions |

| Derivatives Trading Fees | Taker fee: 0.06%, Maker fee: 0.02% |

| Leveraged Tokens Fees | 0.2% per transaction, 0.03% daily management fee |

| Deposit Fees | None |

| Withdrawal Fees | Based on blockchain network fees, varies by token/coin |

| Third-party Payment Methods | Paxful, XanPool, Transak, Ramp, Coinify, Mercuryo, Banxa |

| Security Measures | Multi-factor authentication, cold storage for 90%+ funds, encryption, regular security audits |

| KYC | Optional KYC |

| Withdrawal Limits | non-KYC users: 1.5 BTC/day KYC users: 6 BTC/day |

| Key Features | Futures trading, leveraged tokens, copy trading, demo trading, trading bots |

| Mobile App | Available on Android and iOS |

| Customer Support | Help Center, support requests, live chat |

BYDFi Fees

Spot Trading Fees

The fee structure for spot trading on BYDFi is divided into two types: Maker and Taker.

Spot trading fees are:

| Trading Pair | Maker Transaction Fee | Taker Transaction Fee |

|---|---|---|

| All Spot Trading Pairs | 0.1% to 0.3% | 0.1% to 0.3% |

The transaction fee rate can be found in the upper-right corner of the spot trading pair page.

Note:

- Maker and Taker fees are charged separately

- The trading fee is charged in the purchased cryptocurrency.

- No fee is charged for unfilled or canceled parts of orders.

- The transaction fee rate for converting is 0.1% to 0.15%.

Derivatives Trading Fees

For perpetual contracts, which include USDT-M and COIN-M contracts, the fees are different. The Taker fee is set at 0.06%, while the Maker fee is 0.02%.

Here is the futures fees for high-volume traders:

| VIP Level | 30-Day Trading Volume (USDT) | Asset Balance (USDT) | Maker Fee | Taker Fee | Withdrawal Limits |

|---|---|---|---|---|---|

| VIP 1 | ≥ 10,000,000 | ≥ 50,000 | 0.016% | 0.04% | 12 BTC |

| VIP 2 | ≥ 20,000,000 | ≥ 500,000 | 0.014% | 0.038% | 20 BTC |

| VIP 3 | ≥ 50,000,000 | ≥ 1,000,000 | 0.012% | 0.035% | 25 BTC |

| VIP 4 | ≥ 100,000,000 | ≥ 2,000,000 | 0.01% | 0.032% | 35 BTC |

| VIP 5 | ≥ 200,000,000 | ≥ 3,000,000 | 0.008% | 0.032% | 40 BTC |

Leveraged Tokens and Conversion Fees

Trading leveraged tokens comes with a 0.2% fee on each purchase or sale of USDT. Moreover, a daily management fee of 0.03% of the actual value of leveraged tokens is applied at midnight (UTC+8).

On the BYDFi platform, converting crypto assets incurs a transaction fee ranging from 0.1% to 0.15%.

Deposit and Withdrawal Fees

BYDFi does not charge deposit fees for crypto or fiat currencies. However, payment providers may have their own fees.

Withdrawals have a flat fee that covers cryptocurrency transaction costs from BYDFi accounts. These rates depend on blockchain network fees. These fees can change suddenly because of network congestion. For the most current BYDFi withdrawal fee rates, users should check the latest details on the platform.

| Token/Coin | Network | Deposit Fee | Minimum Withdrawal | Withdrawal Fee |

|---|---|---|---|---|

| USDT | TRC20 | Free | 15 | 0.19 |

| BEP20 (BSC) | Free | 15 | 0.19 | |

| ERC20 | Free | 55 | 5 | |

| MATIC | Free | 10 | 1 | |

| SOL | Free | 10 | 1 | |

| USDC | TRC20 | Free | 10 | 0.3 |

| BEP20 (BSC) | Free | 10 | 0.3 | |

| ERC20 | Free | 55 | 5 | |

| MATIC | Free | 10 | 1 | |

| SOLANA | Free | 10 | 1 | |

| BTC | BTC | Free | 0.003 | 0.000014 |

| BEP20 (BSC) | Free | 0.00025 | 0.0000087 | |

| ETH | ERC20 | Free | 0.015 | 0.004 |

| BEP20 (BSC) | Free | 0.0028 | 0.00016 |

BYDFi Payment Methods

BYDFi crypto exchange only allows direct crypto deposits and withdrawals. Fiat currency deposits are managed by BYDFi works with many payment providers, including:

- Paxful

- XanPool

- Transak

- Ramp

- Coinify

- Mercuryo

- Banxa

Users can make transactions in different ways. They can use electronic payments, cash deposits, or Visa and Mastercard credit or debit cards.

However, our review shows that users cannot withdraw fiat or crypto through these third-party processors. Users must complete KYC verification on the payment provider’s website before making any deposits.

Security Measures: Is BYDFi Safe to Use?

- BYDFi uses multi-factor authentication (MFA). This means you need a password and a second verification method, like a code sent to your phone or an authentication app. This process greatly lowers the chance of unauthorized access.

- Most of BYDFi’s funds are in cold wallets. These wallets are offline and not connected to the Internet. This setup offers strong protection against hackers. Even if online systems are compromised, most user assets stay safe.

- BYDFi encrypts sensitive data to keep it secure. All personal details and transaction records are encrypted during transmission and storage. This way, if data is intercepted, unauthorized parties can’t access or misuse it.

Key Numbers and Data:

- Cold Storage: Over 90% of funds are stored in cold wallets.

- Uptime: BYDFi boasts a 99.9% uptime, thanks to robust DDoS protection.

- Security Audits: Conducted quarterly, both internally and by external firms.

BYDFi KYC and Withdrawal Limits

The verification process on BYDFi is quick and offers benefits, but it is optional. You can use many features, like trading options, crypto pairs, and fiat currencies, without KYC verification.

However, users who deposit fiat must complete KYC authentication before they can withdraw. Generally, users who skip KYC can still withdraw coins, but their limits will be different from verified accounts. If risk control measures are triggered, KYC becomes mandatory for processing withdrawals.

Unverified users can withdraw up to 1.5 BTC daily. Verified users have a higher limit of 6 BTC per day. For VIP users, withdrawal limits vary based on their specific status.

Key Features of BYDFi Reviewed

Futures Trading

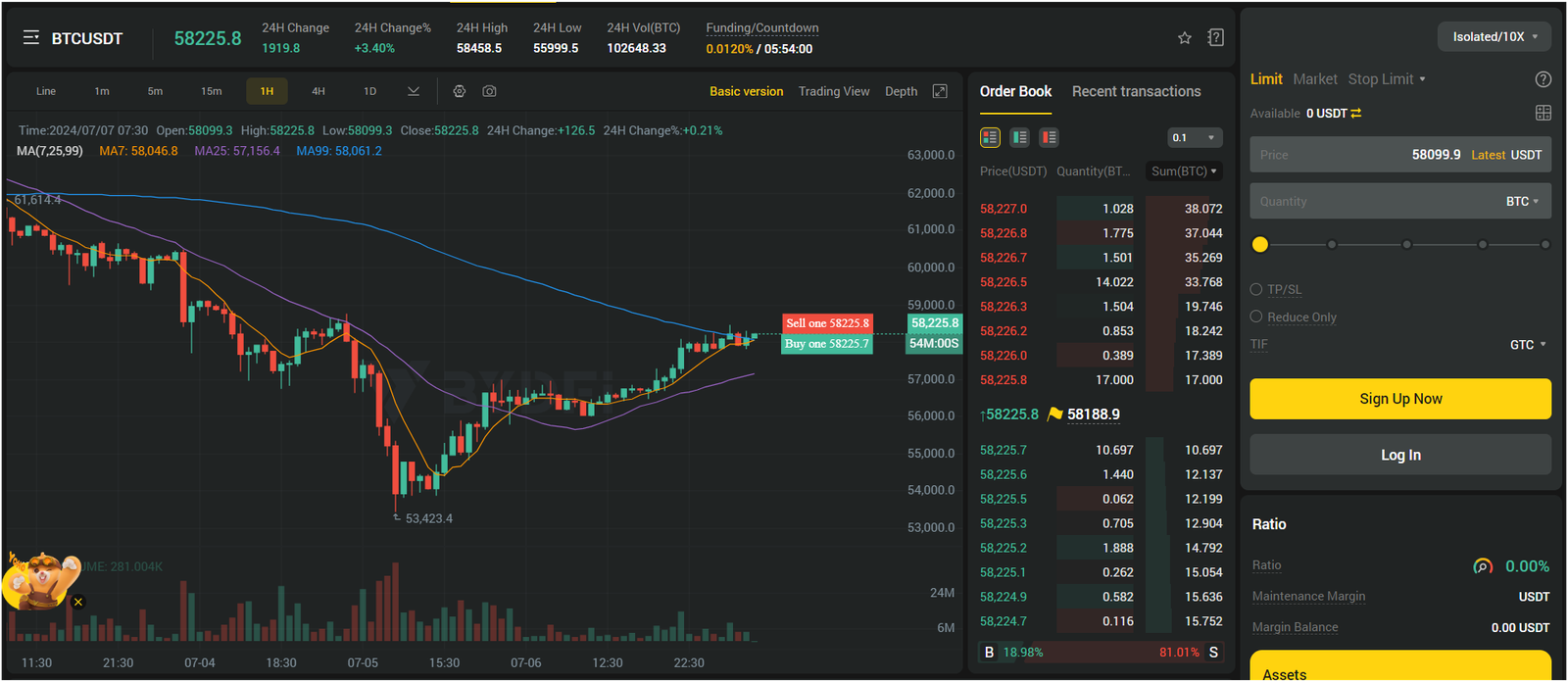

Our BYDFi review shows that you can speculate on future cryptocurrency prices. There are two types of futures contracts: USDT-M and COIN-M.

USDT-M futures use USDT as collateral. COIN-M futures use the actual cryptocurrency, like BTC.

Perpetual contracts are popular on BYDFi. They have no expiry date, which allows for continuous trading.

Margin modes include isolated and cross-margin.

In isolated margin mode, each position has its own margin. This limits potential losses to that position only. In cross-margin mode, your entire account balance is used to maintain positions. This approach helps prevent liquidation but risks your whole balance.

BYDFi’s platform offers various leverage levels, up to 200x. You can choose your risk level. Lower leverage means less risk and reward, while higher leverage increases both.

Leveraged Tokens

BYDFi offers unique tokens called “leveraged tokens.” These tokens provide amplified exposure to cryptocurrency price changes.

Here’s how it works:

- Regular tokens: A 10% rise in Bitcoin means a 10% value increase.

- Leveraged tokens: For example, BTC3L increases by 30% if Bitcoin rises by 10%. This means three times the profit potential.

Leveraged tokens can lead to bigger profits but also come with high risks. Losses can be magnified as well. These tokens are ideal for experienced traders who understand the risks involved.

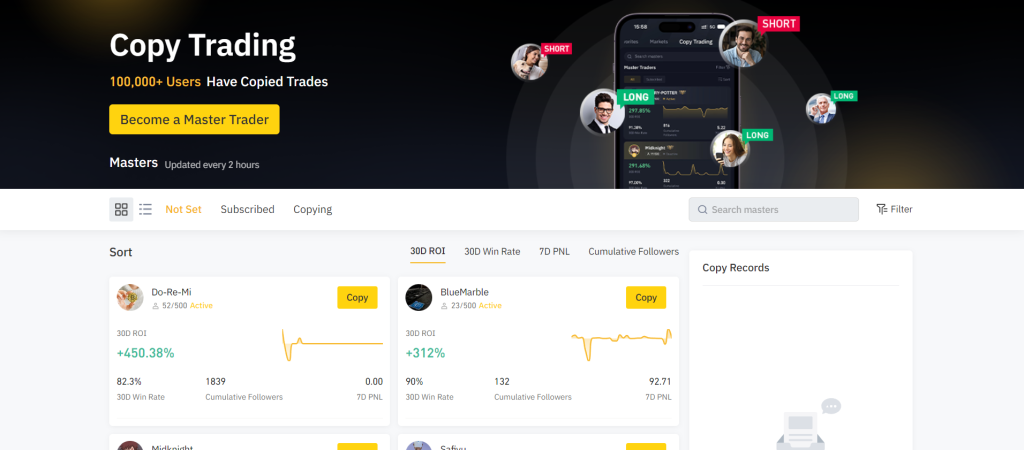

BYDFi Review: Copy Trading

BYDFi’s copy trading feature lets crypto traders copy the strategies of skilled participants. This simple and clear approach helps both traders and followers boost their earnings.

Traders on BYDFi have profiles that display important details. These include Profit Rate (PR), Win Rate (WR), P/L ratio, trading days, and follower count. This helps users choose the right trader to follow.

When a trader is selected, their trades are automatically copied in the follower’s account. This mirrors all the gains and losses from the professional trader. It removes the need for manual trade management, making contract trading easier for everyone.

BYDFi supports traders by giving them visibility, followers, and a share of profits. They offer one of the highest profit-sharing rates in the crypto industry. Traders can earn up to 8% of follower profits just by sharing their trading activities.

Demo Trading

BYDFi provides a demo account for practicing trading without real money. This helps you learn the platform and its features. You can test trading strategies and build confidence before trading with real funds.

The demo account simulates the real market, so you won’t lose any money. It’s great for beginners who are learning to trade and for experienced traders testing new strategies safely.

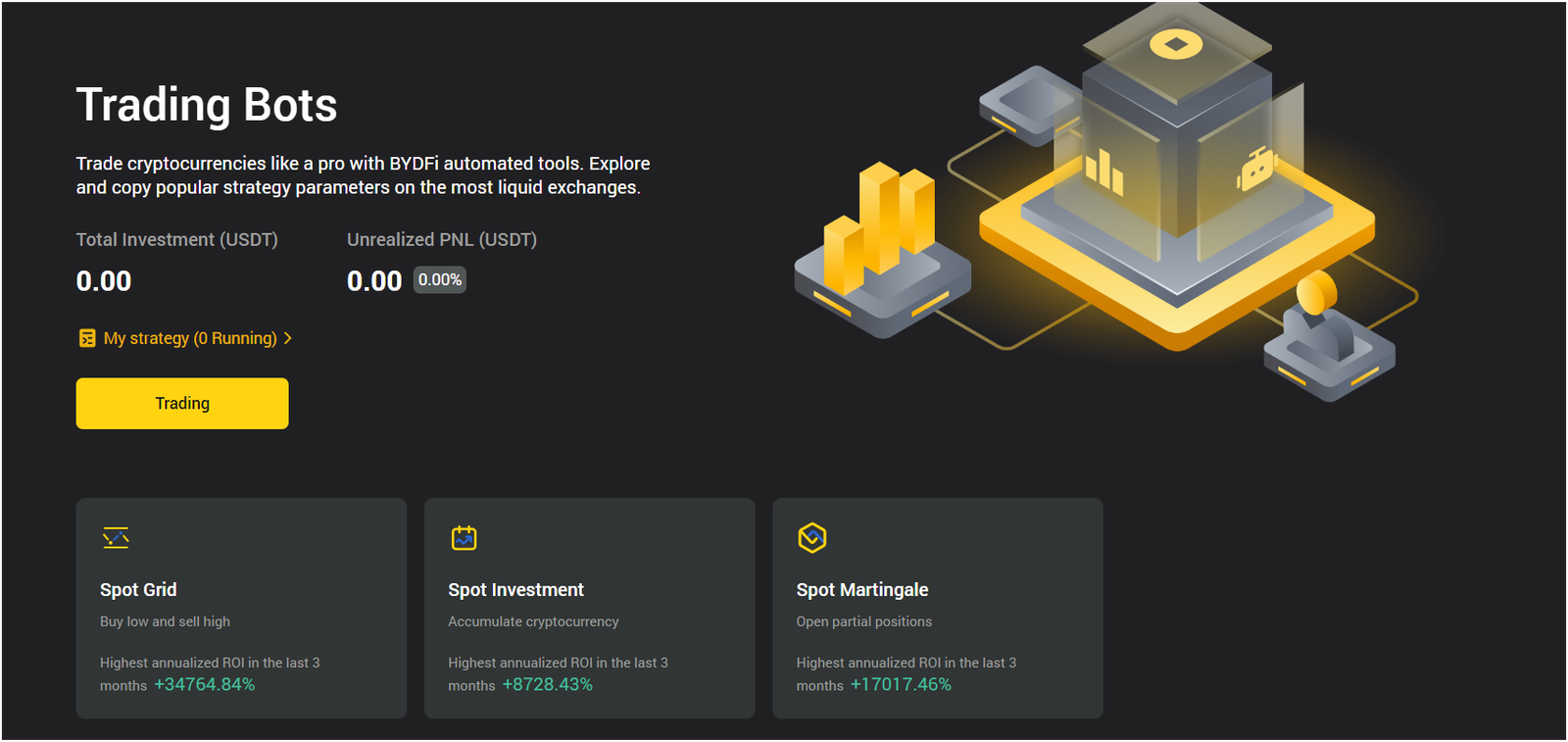

Trading Bots

BYDFi lets you automate crypto trading strategies with bots, aimed at different trading goals. Here’s a look at three popular bot strategies:

- Spot Grid Trading Bot: This bot works within a set price range for a cryptocurrency. For instance, if you set a range of $10,000 to $12,000 for Bitcoin (BTC), the bot places buy orders below $10,500 and sell orders above $11,500. The goal is to profit from small price changes by buying low and selling high within that range.

- DCA (Dollar-Cost Averaging) Bot: This bot follows a steady investment plan. It invests a fixed amount into a cryptocurrency regularly—daily, weekly, or monthly. This approach helps average the purchase price over time and reduces the impact of market swings.

- Martingale Bot: This bot is known for its high-risk, high-reward strategy. It increases the investment amount after each losing trade. The idea is to eventually make a winning trade that not only recovers losses but also generates profit.

BYDFi Mobile App

The BYDFi mobile app lets you manage your crypto assets on Android and iOS. It offers many trading features. You can trade over 500 coins for spot trading and use up to 200x leverage for derivatives.

The app includes Lite Contracts, leverage tokens, perpetual contracts, and other derivatives. It offers different order types for trading derivatives. These include Stop Market, Stop Limit, Automatic Margin Call, and Trailing Stop.

You can explore different trading styles and filter cryptocurrencies to match your preferences. The app also allows you to create personalized trading systems. For beginners, the copy trading feature is great for learning strategies with low risk.

Lastly, the app has advanced tools for experienced traders. These include detailed charting tools, real-time crypto market data, and automated trading bots.

Trading Experience

BYDFi is built for both new and experienced crypto traders. Its user-friendly interface makes it easy to navigate. Beginners can start with simple spot trading to buy and sell cryptocurrencies. Seasoned traders can dive into derivatives, like leveraged tokens. These amplify price movements and come with higher risks and rewards.

The platform also offers copy trading. This feature lets users mimic successful traders, making it easier to make informed decisions. For risk management, BYDFi includes tools like stop-loss orders. These automatically sell coins if their value drops sharply.

Depositing funds is simple. Users can choose from Visa, Apple Pay, or bank transfers. However, BYDFi lacks some features found on other exchanges, like crypto staking or lending. These options allow users to earn interest on their holdings or loan them out for profit.

As a newer exchange, BYDFi might have lower trading volumes and less brand recognition than more established platforms. Let me know if you need more changes.

BYDFi Customer Support and Reviews

If you need help with your BYDFi account or have questions, here are some ways to reach customer support:

- BYDFi Help Center: This is where many users start. The Help Center has a lot of information, including FAQs, guides, and tutorials on using the platform, trading, and fixing common issues. You can find it on the BYDFi website.

- Submit a request: You can submit a support request through their website. Choose from different categories based on your issue and provide details about your request.

Before using BYDFi, check reliable reviews. The app has a 4.6/5 rating, with positive feedback on the trading experience and futures market. However, some negative reviews mention withdrawal limitations.

BYDFi Alternatives

Binance and KuCoin are the best derivatives crypto exchanges or futures crypto exchanges and are the best alternative to BYDFi exchange. You can also read our review of other crypto exchanges like Bitget review and Bybit review.

Binance

KuCoin

How to Get Started on BYDFi Platform?

Here’s a step-by-step guide to getting started with the BYDFi platform:

- Create your account: Go to the BYDFi website and click “Register” in the top-right corner. Fill out the form with your email and a secure password. Verify your email using the code sent to you. Use the BYDFi referral code during signup to get a bonus.

- Security first: After logging in, secure your account. Enable Two-Factor Authentication (2FA) for extra protection. Use a strong password for withdrawals. Also, make an allowlist for withdrawal addresses. This way, you can send funds only to approved locations.

- KYC verification (optional but recommended): Doing KYC verification lets you withdraw more and access extra features. You’ll likely need to submit a government-issued ID and possibly a selfie.

- Fund your account: BYDFi offers various deposit methods based on your location. You can transfer crypto from another wallet or deposit using options like Visa, Apple Pay, or bank transfers, if available.

- Explore the platform: Get to know BYDFi’s layout. It has sections for:

- Spot Trading (buying and selling crypto)

- Futures Trading (leveraged returns)

- Copy Trading (replicating successful trades)

- Start trading: Use BYDFi’s demo account to practice trading in a simulated environment. When you’re ready, choose your trading strategy and start placing orders.

Final Verdict

Our BYDFi review shows it has a user-friendly platform for new and experienced traders. Its intuitive interface and diverse trading options make it easy to start and grow your crypto holdings. Features like copy trading add to its appeal.

But, be aware of some drawbacks. There are no fiat withdrawals or staking services, which are common on other exchanges. Also, as a newer platform, it has lower liquidity.

FAQs on BYDFi Exchange Review

What is BYDFi?

BYDFi, formerly known as BitYard, is a cryptocurrency exchange that started in 2019. It rebranded in 2023. The platform offers many trading services. These include spot trading, derivatives trading, and copy trading. BYDFi aims to make trading easy while providing advanced features. It serves users in over 150 countries.

What cryptocurrencies are available on BYDFi?

BYDFi offers more than 500 spot trading pairs. You can trade popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), Avalanche (AVAX), and Litecoin (LTC).

Does BYDFi offer staking rewards?

No, BYDFi does not offer staking rewards right now. The platform provides various trading services like spot trading, derivatives, and leveraged tokens. However, staking features are not available at this time.

Who is BYDFi best for?

BYDFi works well for both new and experienced traders. Beginners can use simple interfaces like the “convert” feature to exchange cryptocurrencies easily. Advanced traders benefit from tools such as 200x leverage and various order types. Also, the copy trading feature helps those who want to follow the strategies of seasoned traders.

Can BYDFi be trusted?

In our BYDFi review, we found that it uses strong security measures to protect user assets. These include two-factor authentication (2FA), withdrawal PINs, and deep cold storage for funds. The platform also offers responsive customer support with live chat and a help center. This boosts its reliability and trustworthiness.

Which countries are supported by BYDFi?

BYDFi serves users in over 150 countries, offering a global trading platform. It does not offer services or KYC for users in China, Pakistan, Bangladesh, Kazakhstan, the UK, and Iran. The platform accepts several fiat currencies, such as USD, GBP, EUR, AUD, and AED, making it accessible to many users worldwide.

Is BYDFi regulated?

Yes, BYDFi is registered with US FinCEN and Canada FINTRAC.