Table of Contents

The cryptocurrency market is now a global phenomenon. It allows anyone to invest, no matter where they are. With many exchanges out there, picking the right one can feel overwhelming. In this CoinW review, we will look at the platform’s features and see if it suits traders of all experience levels.

CoinW serves millions in 120 countries. It offers various trading options, like spot, futures, and ETFs. This range helps investors create a balanced portfolio. Frequent traders can also benefit from lower fees. However, one downside is that CoinW lacks crypto-fiat trading pairs. If you need direct fiat conversions, you might consider alternatives like Binance, Bybit, or Bitget.

Is CoinW a reliable choice? Can it support both beginners and experienced traders? This review gives a detailed analysis to help you decide.

Quick Verdict: CoinW is a global trading platform for new and experienced traders. It prioritizes security and offers various services, such as mining, staking, and trading. You can trade in spot, futures, and ETFs, with leverage up to 200x. The platform isn’t available in the United States. Also, it doesn’t support crypto-fiat trading pairs.

CoinW Exchange Overview

| Key Term | Description |

|---|---|

| Established | 2017 |

| Global Presence | Available in over 120 countries, serving 10 million users and 7 million daily traders. |

| Trading Options | Spot, Futures, ETFs, P2P, Margin, Copy Trading, OTC, Mining, and Staking. |

| Leverage | Up to 200x for futures and ETFs. |

| Supported Cryptocurrencies | Over 1,000, including altcoins like BTC, ETH, SOL, and APT |

| Fiat Currencies | 40+ including USD, JPY, MXN, and DKK. |

| Security | Multi-layer protection, 2FA, KYC verification, IP tracking, cold & hot wallets, sharding, multi-sig, KYT system, and DDOS defense. |

| No-KYC Trading | Yes, up to 2 BTC per day withdrawal limit |

| Fees | 0.2% for makers and takers in spot trading, with discounts for higher trading volumes. Futures fees: 0.04% (makers), 0.06% (takers). |

| Mobile App | Available for iOS and Android |

| LaunchPad | Provides early access to new crypto projects and tokens. |

| Crypto Card | Powered by VISA, spending crypto in 176+ countries by converting it to fiat instantly. |

| Regional Restrictions | Not available in the US and Japan due to regulatory issues. |

| Customer Support | 24/7 live chat support. |

| Drawbacks | CoinW lacks crypto-to-fiat trading pairs and has lower liquidity compared to these platforms |

What is CoinW?

Before we review CoinW in detail, let’s look at its history and global reach. CoinW began in 2017, founded by experts in cryptocurrency, cybersecurity, and finance. It has quickly grown to serve traders around the world. Now, it operates in over 120 countries and is one of the largest digital asset platforms. CoinW supports 10 million users and handles 7 million daily transactions, making it a top crypto exchange.

CoinW runs 16 local trading platforms in 13 countries. It covers important regions like Asia-Pacific, Europe, and Australia. The platform supports many languages. Users can buy cryptocurrencies with over 40 fiat currencies, including USD, JPY, MXN, and DKK.

What extra features does CoinW offer? The platform has many investment options and allows leverage up to 200x for some assets. This raises important questions: Is CoinW a legitimate platform?

What We Like: CoinW Pros Reviewed

User Funds are Safe with Multiple Security Measures

For over seven years, CoinW has operated without security breaches or hacking incidents. So, what safeguards make this possible?

CoinW employs multiple layers of protection, starting from login security. To safeguard user accounts, the platform enforces mandatory Know Your Customer (KYC) verification and recommends enabling two-factor authentication (2FA) via tools like Google Authenticator. The same security measures apply to coin withdrawals and API key creation.

Additionally, CoinW monitors user IP addresses to verify account access and detect unauthorized activity. The system continuously tracks suspicious behaviors, such as unusual login attempts or irregular transactions, responding in real time. If any fraudulent activity is detected, users receive instant alerts, enabling swift action. High-risk transactions undergo further manual review to mitigate threats.

CoinW also holds the Digital Currency Trading Service License issued by AUSTRAC (Australian Transaction Reports and Analysis Centre), ensuring regulatory compliance and secure Spot trading.

To safeguard digital assets, CoinW utilizes multi-party computation (MPC) to enhance blockchain privacy—an advanced security approach different from traditional banking methods. Assets are stored in multiple vaults, commonly known as hot and cold wallets. Larger holdings remain in cold storage wallets, while hot wallets serve as backups for quick access.

These storage vaults are secured through sharding, a technique that splits private keys into several fragments and stores them separately. Even if an attacker obtains one key fragment, they cannot access funds without the remaining pieces.

Furthermore, CoinW ensures transaction security through multi-signature technology (multi-sig)—requiring multiple approvals before funds leave an account. Every wallet interacting with the blockchain undergoes Know Your Address (KYA) verification, while transactions are assessed using Know Your Transaction (KYT) compliance checks to align with Anti-Money Laundering (AML) regulations.

CoinW is also equipped to combat cyber threats with advanced security defenses, including DDOS protection, Web Application Firewall (WAF), and BOT guard.

Staking, ETFs, Trading Bots, and OTC Market

CoinW supports over 1,000 cryptocurrencies, including popular altcoins and newly launched projects like Arbitrum, Aptos, Sui, Scroll, and EigenLayer. With such a broad selection, users can diversify their portfolios through staking or mining via CoinW’s hybrid programs. Staking offers an Annual Percentage Yield (APY) of approximately 15%, allowing investors to earn passive income on their holdings.

Additionally, CoinW facilitates crypto ETF trading, which functions similarly to traditional ETFs but incorporates leverage. These ETFs track the daily movements of digital assets, enabling users to amplify gains by up to 6x—without requiring collateral for leveraged positions.

Additional Features offered by CoinW:

- DCA Bots: CoinW offers Dollar-Cost Averaging (DCA) bots, allowing users to automate crypto purchases on a daily, weekly, or monthly schedule. Investors can select assets like BTC, LINK, or DOT, ensuring a steady accumulation strategy.

- OTC Trading: Designed for high-net-worth individuals and institutional clients, CoinW OTC enables large transactions to be executed without price slippage, enhancing liquidity and trade efficiency.

As demonstrated in this CoinW review, there is something for everyone.

Leverage Trading for Experienced Traders

For those interested in high-risk trading, futures trading on CoinW provides great opportunities. The platform supports perpetual futures contracts with leverage of up to 200x. This allows traders to keep positions open indefinitely, as there is no expiration date. Available futures pairs include BTC/USDT, SOL/USDT, APT/USDT, and SUI/USDT.

CoinW handles approximately $5.8 billion in daily trading volume and offers 115 trading pairs, all linked to perpetual contracts. Users can choose between cross and isolated margin modes to fit their trading strategies. This means they can merge or split their positions as needed.

Traders who want to take on more risk can go long or short, depending on market trends. BTC leverage can reach 200x, while smaller altcoins like ADA, APT, SOL, and ATOM have a maximum leverage of 75x. CoinW offers a profit and liquidation calculator for traders. However, estimates can change due to market fluctuations.

Additional Trading features include:

- Fee Discounts for Active Traders: As trading volume rises, maker and taker fees drop, giving savings for frequent traders. More details are in the fee structure section.

- ETF Trading with Leverage: CoinW also offers crypto ETFs with margin and leverage options. Traders can go long or short with leverage from x3 to x6.

- Easy-to-Use Trading Interface: CoinW’s platform is great for everyone. It offers simple charts, helpful indicators, and an order book for all traders. This makes it easy to track prices and execute trades efficiently.

Order Types

CoinW offers several order types to cater to different trading strategies:

- Limit Order: Set a specific price at which you want to buy or sell. The order executes only when the market reaches the designated price. However, in highly volatile conditions, a 0.06% fee applies when placing the order.

- Market Order: Execute trades instantly at the current market price. The platform matches your order with the best available offer, but taker fees apply.

- Conditional Order: Define a trigger price, ensuring the order is executed only when the market meets the specified condition.

- Take Profit & Stop Loss: Manage risk effectively by locking in profits or minimizing potential losses.

Advanced Trading Features Available on CoinW

P2P Trading

CoinW offers Peer-to-Peer (P2P) trading. This lets users buy and sell cryptocurrencies directly with each other. The system provides more flexibility in payment methods. Users can transact using local currency and various payment channels, making it accessible in many regions.

A key benefit is the absence of transaction fees, which makes trades cost-effective. CoinW also uses an escrow service for added security. This protects both buyers and sellers during transactions.

However, processing times may vary since trades happen directly between users. This depends on how quickly the buyer or seller responds. This method is great for those wanting to avoid traditional exchange fees or needing to use local currency.

Quick Buy

The Quick Buy feature on CoinW makes buying cryptocurrency easy. It provides a hassle-free way to get digital assets instantly. This feature is convenient and supports common payment methods, like credit and debit cards. Users can buy cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). They don’t have to worry about the main exchange’s complexities.

Quick Buy is especially great for beginners. It skips advanced trading tools and focuses on a simple purchase process. However, users should note that Quick Buy may have slightly higher fees because of third-party payment providers.

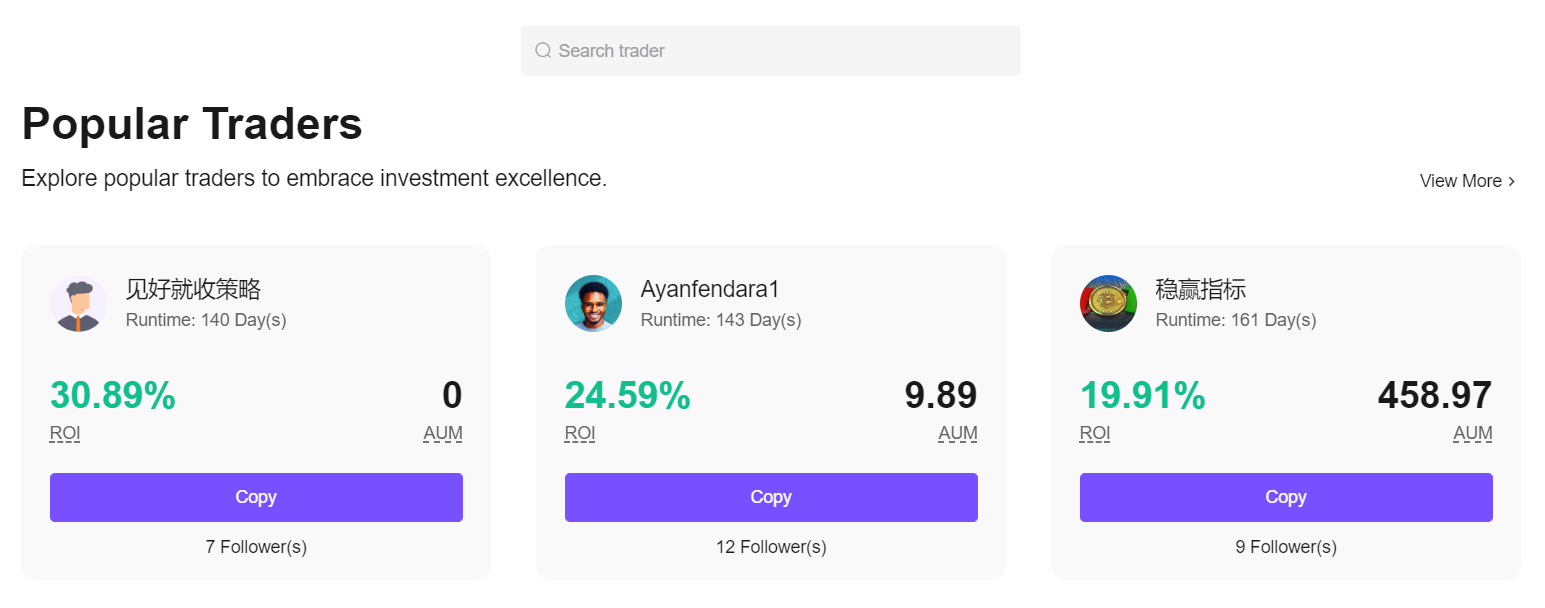

Copy Trading

Copy Trading on CoinW lets you automatically follow top traders’ strategies. This is great for users who lack time or expertise to manage trades actively.

If you’re a skilled trader, others can follow your moves. You’ll earn a 12% commission on their profits and gain more exposure and bonuses.

LaunchPad

CoinW’s LaunchPad offers early access to new crypto projects before they launch widely. This feature lets users invest in promising tokens or projects early, often at a lower price.

It’s a chance to get in on the ground floor of emerging blockchain ventures. Users can maximize returns if the project succeeds. LaunchPads like this are popular in crypto, providing a way into exciting new technologies. However, they carry risks since not all projects succeed in the long run.

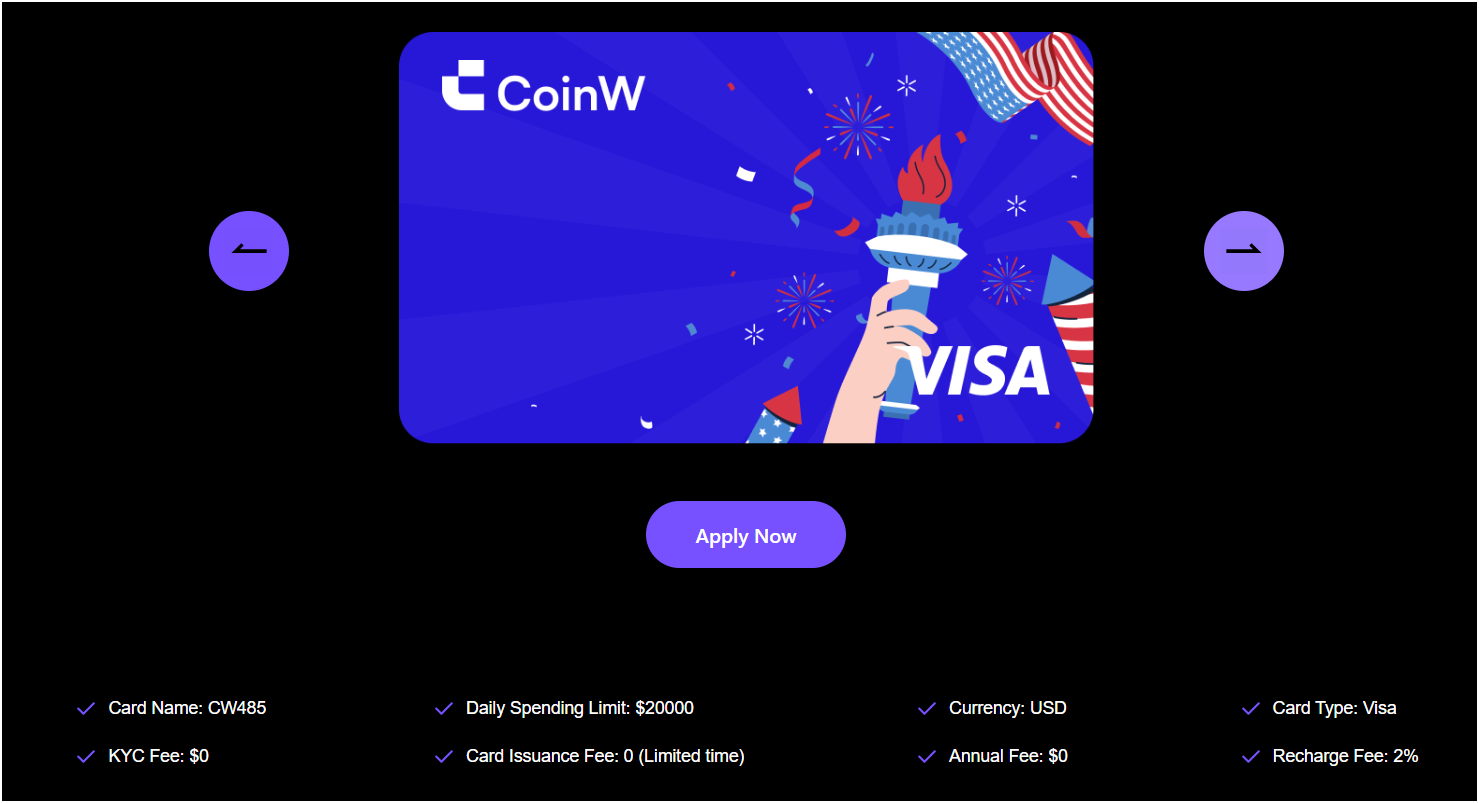

Crypto Card

Powered by VISA, the CoinW Crypto Card lets users spend cryptocurrency easily. It works at millions of merchants worldwide. The card converts crypto into fiat currency, so users can buy anywhere VISA is accepted.

This payment solution is great for online shopping and in-store purchases. It helps integrate crypto into daily life. Available in over 176 countries, the card automatically changes crypto to USD. This provides a smooth experience for crypto holders who want to use their digital assets in real life.

What We Don’t Like: CoinW Cons Reviewed

No Crypto-to-Fiat Trading Pairs

Earlier, we discussed CoinW’s wide range of crypto-to-crypto trading pairs. However, crypto-to-fiat pairs are not available right now. This may disappoint users seeking easy fiat conversion.

You can still convert crypto to fiat, but it requires third-party payment services. During my testing, I found that payment methods don’t show up right away. Transactions go through providers like ACH, MoonPay, Advcash, and Mercuryo. This can be limiting, especially if these services aren’t available in your area.

CoinW supports about 40 fiat currencies, which is good but less than what top exchanges like Bitget or Bybit offer. With CoinW’s fast growth, I hope they expand their fiat payment options for better access.

To tackle some payment issues, CoinW has its own crypto debit card, backed by VISA. This card lets users spend crypto on daily purchases and works in over 176 countries. It’s a flexible payment option for users worldwide.

Not Available in the U.S.

If you’ve been looking into CoinW, you may have seen mixed reports about its availability in the United States. The truth is that CoinW is not available to US residents.

This is unfortunate since the US has a large crypto user base. Stricter regulatory policies, especially after the FTX collapse, have led to more scrutiny of crypto exchanges. This makes it tough for platforms like CoinW to operate in the country.

If you’re in the United States, there are many reliable alternatives that offer similar services without legal issues, such as:

- Crypto.com

- Coinbase

As noted, CoinW’s crypto debit card, backed by VISA, lets users make crypto payments worldwide. It can be used wherever VISA is accepted, converting USD to USDT automatically. However, its legal status in the US is unclear, so it’s wise to check for any restrictions before using it there.

While CoinW’s official terms don’t state anything about VPN usage, using a VPN to bypass geographical limits is generally not recommended, as it could create compliance risks.

Besides the US, CoinW is also not available in Japan. However, it remains open in several areas with strict crypto regulations, including the United Kingdom and Singapore.

CoinW Fees and Pricing

Now that we’ve looked at the pros and cons of CoinW, let’s explore its pricing and fee structure.

CoinW charges a flat fee of 0.2% for both makers (users placing limit orders) and takers (users filling those orders). High-volume traders can enjoy discounted fees, which lower costs as their trading activity rises.

| VIP Level | Validity Time | Maker Fee | Taker Fee | Price(CWT) |

|---|---|---|---|---|

| V1 | 1 month | 0.20% | 0.20% | 0 |

| V2 | 1 month | 0.15% | 0.15% | 680 |

| V3 | 1 month | 0.12% | 0.12% | 2680 |

| V4 | 1 month | 0.09% | 0.09% | 12800 |

| V5 | 1 month | 0.06% | 0.06% | 38600 |

| V6 | 1 month | 0.01% | 0.01% | 86800 |

For futures trading, CoinW offers a more competitive fee structure:

- Makers are charged 0.04%

- Takers pay 0.06%

Unlike spot trading, there are no VIP-level discounts for futures traders. For a full breakdown of CoinW’s fee structure, you can find the details here.

User Satisfaction and Customer Reviews

User feedback on CoinW shows a mixed picture. Many traders like its intuitive interface, which makes it easy for beginners. The platform offers a wide selection of trading pairs, including perpetual contracts for popular pairs like BTC/USDT and ETH/USDT. Users also praise the low trading fees, especially for futures trading.

However, some users point out areas for improvement. A common issue is the lack of crypto-to-fiat trading options, which can make it hard to cash out directly. Some people say customer support is slow to respond. This can be frustrating, especially when there are urgent issues like account problems or withdrawals. Also, relying on third-party payment providers can be limiting. This is especially true in areas where some services aren’t available.

Overall, CoinW tends to get moderate ratings, usually between 3.5 and 4 stars out of 5. While its features and fee structure are appreciated, there is a need to improve customer support and fiat withdrawal options.

CoinW Review: User Interface and Design

CoinW’s user interface and design are well-liked by traders for their intuitive layout. This makes navigation easy for both beginners and experienced users. The platform has a clean structure. It keeps essential tools, charts, and market data accessible. This helps traders track price movements and make decisions efficiently.

On both desktop and mobile, CoinW offers real-time data, including indicators, order books, and customizable charts. The desktop version has a wider range of trading tools. Meanwhile, the mobile app is great for keeping users updated on the go.

Some traders think the mobile app could use more advanced features. Still, CoinW’s design balances functionality and simplicity, making it a solid choice for most users.

CoinW Alternatives Crypto Exchanges

Bitget and KuCoin are the best alternatives to CoinW Exchange. Here is a quick CoinW vs. Bitget and CoinW vs. KuCoin comparison:

Bitget (Best For Crypto Copy Trading)

- Top Features: Spot, Futures with 125x leverage, Trading bots, and Copy trading

- Supported Coins: 850+ including low-cap altcoins

- Trading Fees: 0.1% maker/taker

- Deposit methods: Bank transfer, debit/credit card, P2P marketplace

KuCoin (Best For New Altcoin Trading)

- Top Features: Spot, Futures, Margin, Trading bots, and P2P Trading

- Supported Coins: 700+ including new altcoins

- Trading Fees: 0.1% maker/taker

- Deposit methods: Visa, Mastercard, SEPA, UPI, Faster Payment System (FPS), and 70+ more

How to Get Started on CoinW Exchange?

Step 1: Create an Account on CoinW

Go to the CoinW website and click the “Sign Up” button. Enter your email or phone number, then set a password. After you register, you will receive a verification code via email or SMS. Enter this code to activate your account. You can also use the CoinW referral code “2821338” when signing up. This will let you claim a sign-up bonus and referral rewards of up to 100 USDT.

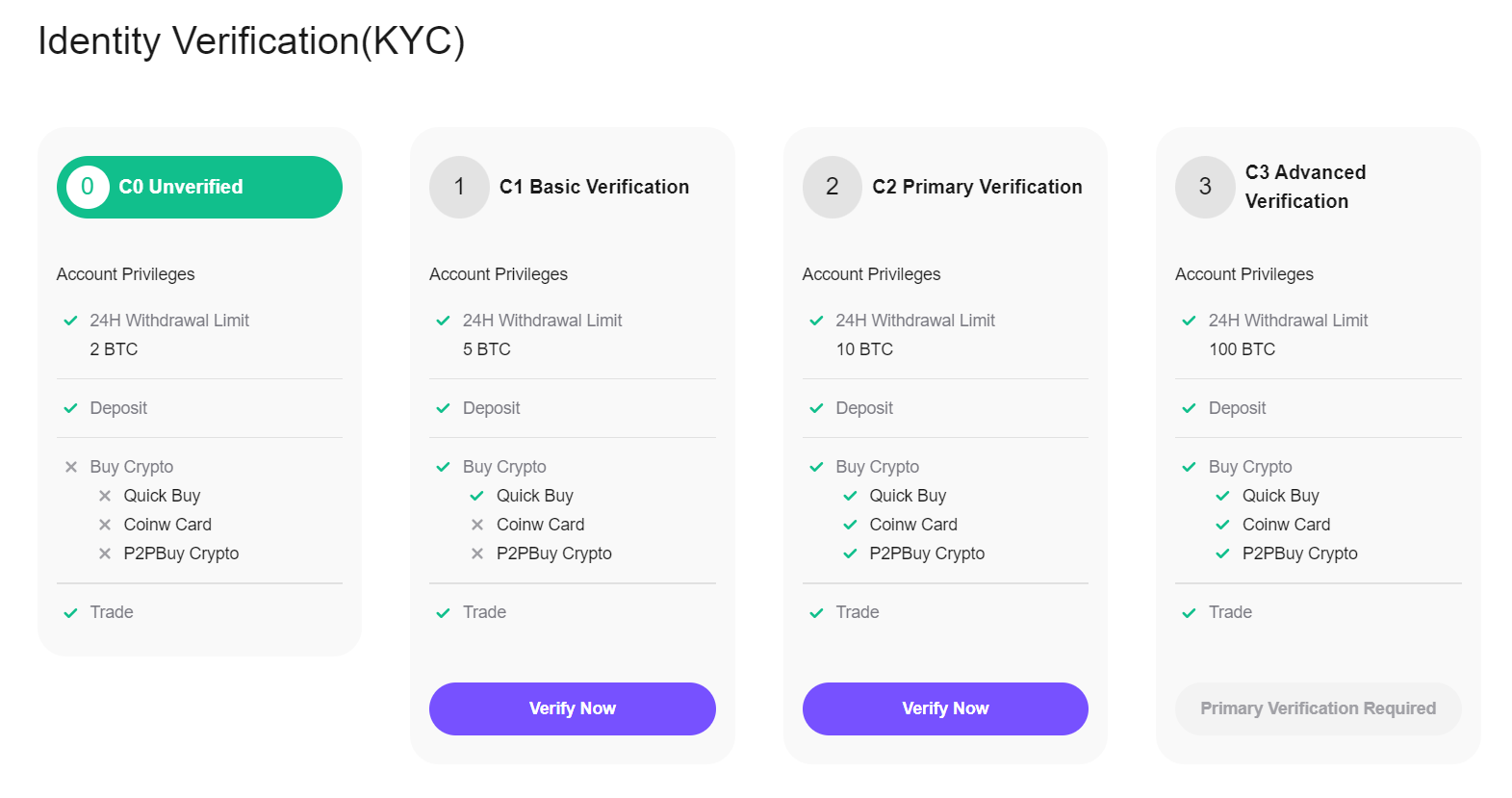

Step 2: Complete KYC Verification

After you create your account, CoinW needs you to finish KYC (Know Your Customer) verification. This adds security and unlocks all features. Go to the “Account” section and choose “KYC Verification.” You’ll need to upload a government-issued ID and a selfie to confirm your identity. This process may take a few hours to several days, depending on the volume of requests.

CoinW has several KYC verification levels, each with different withdrawal limits:

- No identity verification (C0): Withdrawals up to 2 BTC per day or an equivalent in other cryptocurrencies.

- Basic identity verification (C1): Daily withdrawal limit increases to 5 BTC or an equivalent amount.

- Primary verification (C2): Users can withdraw up to 10 BTC per day or the corresponding value in other assets.

- Advanced verification (C3): Highest withdrawal limit, allowing up to 100 BTC per day or its equivalent.

Each KYC level offers more security and access.ion required for larger withdrawals.

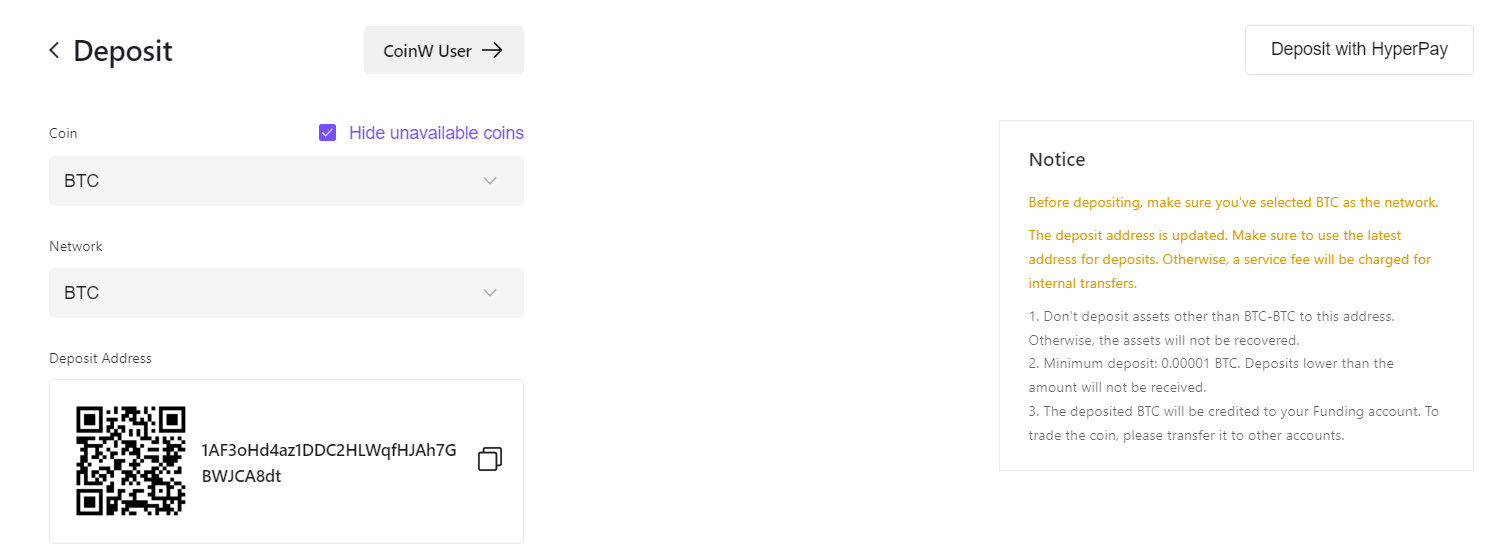

Step 3: Deposit Cryptocurrency or Fiat

After verification, go to the “Assets” tab and select “Deposit.” To deposit cryptocurrency, pick your coin and copy the wallet address or scan the QR code. If you want to deposit fiat, CoinW accepts several third-party payment methods, like ACH and credit cards.

Step 4: Start Trading and Buy Crypto on CoinW

To start trading on CoinW, go to the Markets or Trade section. You can choose spot or futures trading. If you want to trade right away at the current market price, select a market order. If you want more control, use limit orders to set the price for your order. For quick purchases, the Quick Buy feature lets you buy cryptocurrency instantly without going through the main exchange.

Step 5: Withdraw Funds from CoinW

To withdraw, go to “Assets” and select “Withdraw.” Choose the cryptocurrency you want to withdraw. Enter the recipient’s wallet address and confirm the transaction. For fiat withdrawals, use supported third-party methods like Mercuryo or ITEZ, based on your region.

Final Verdict

This CoinW review looks at the platform’s features. It offers competitive trading fees, P2P trading, and futures options. Its easy-to-use interface attracts both new and experienced traders. Features like Copy Trading and LaunchPad also help.

Still, some limitations exist. Some users may face limited access due to the lack of fiat trading pairs and regional restrictions. Overall, CoinW balances functionality and innovation. It’s important to see if its offerings match your specific trading needs before you commit.

FAQs on CoinW Exchange Review

Is CoinW trustworthy?

Yes, CoinW is seen as a trustworthy exchange in the crypto community. It holds various financial licenses. These are the Money Services Business (MSB) license in the US and the Monetary Authority of Singapore (MAS) license. These licenses boost its regulatory credibility.

To protect user funds, CoinW uses strong security measures. This includes two-factor authentication (2FA) and cold storage for assets. The platform also follows global regulations, which adds to its reliability.CoinW has more than 7 million users around the globe. It offers a safe and trusted platform for cryptocurrency trading.

How much does CoinW charge for withdrawal?

CoinW has withdrawal fees that change based on the cryptocurrency. For instance, the fee for Bitcoin (BTC) is usually about 0.0006 BTC. This amount can vary due to network conditions. Other cryptocurrencies have different fees. Fiat withdrawals may also have charges, depending on the payment method.

Does CoinW require KYC?

Yes, CoinW requires users to complete Know Your Customer (KYC) verification. This step is necessary to access certain features and raise withdrawal limits. The platform has multiple KYC levels. The highest level allows withdrawals of up to 100 BTC per day.

For those who want limited verification, zero-KYC accounts are an option. However, these accounts have lower withdrawal limits, starting at 2 BTC per day without verification. Completing KYC is key for full access to the platform. It also helps ensure regulatory compliance. This makes KYC a must for traders wanting to maximize their withdrawal capabilities.

Does CoinW have an app?

Yes, CoinW has a mobile app for iOS and Android. It also offers desktop versions for Windows and MacOS. The app delivers a smooth, real-time trading experience. It includes all core features like spot and futures trading, asset management, and account settings.

Why choose CoinW?

CoinW is a great option for beginners and experienced traders. It has low fees, many trading pairs, and advanced features like Copy Trading and LaunchPad. The platform supports spot and futures trading with competitive withdrawal fees. It also has strong security measures. Available in multiple languages, CoinW offers high leverage on futures trades. This makes it ideal for global users looking for both simplicity and professional trading.

Can Credit Cards be used on CoinW?

Yes, CoinW allows you to pay with credit and debit cards through third-party providers. This feature lets users buy popular cryptocurrencies fast. They can use their cards for Bitcoin (BTC) and Ethereum (ETH).