Thinking about cryptocurrency? MEXC is a well-known crypto exchange. It’s popular among beginners and experienced traders alike. Whether you’re new to buying or seeking a reliable platform, MEXC is worth considering.

In this MEXC review, we’ll cover what you need to know. We’ll discuss its key features, fees, security, and user experience in simple, clear terms.

Table of Contents

MEXC Review At a Glance

- Best For: Zero fees and No-KYC trading

- Supported Coins: 2,200+ trading pairs

- Trading Fees: 0%

- Maximum Leverage: 200x futures contracts

- Security: 2FA, Cold Storage, Anti-phishing code, SSL, and more

- Fiat Currencies: VND, RUB, and KRW in the P2P market

- Deposit Methods: Credit card, global bank transfer (SWIFT), P2P trading, and third-party payments (Simplex, Banxa, MoonPay).

MEXC is a popular cryptocurrency exchange that launched in 2018. It stands out for offering a wide range of altcoins for over 2,200 cryptocurrencies and its quick listing of new and trending tokens.

One of MEXC’s most attractive features is its no-KYC policy for basic accounts. This means users can start trading quickly without going through a lengthy verification process, which appeals to those valuing privacy. However, higher withdrawal limits and fiat deposits require some form of ID verification.

Plus, MEXC recently introduced zero fees for spot trading, making it highly competitive in the market. It also supports spot trading, futures trading, and P2P trading, catering to various investment strategies. MEXC also offers additional features like staking, crypto loans, and a launchpad. The exchange has its own token, MX, which provides trading fee discounts and other benefits.

Pros

- ZERO fees for the spot market

- 2,200+ coins available for trading

- Advanced trading tools

- 200x leverage trading in the perpetual futures market

- Reliable and fast trading engine

Cons

- No U.S. availability

- Less liquidity in low-cap coins

- Lower regulatory oversight

- No-KYC trading can result in money-laundering

MEXC Exchange Overview

| Key Point | Details |

|---|---|

| Founded | 2018 |

| Our Rating | 4.2/5 |

| Headquarters | Singapore |

| Supported Cryptocurrencies | 2,200+ |

| Spot Trading | Yes |

| Futures Trading | Yes |

| Leverage | Up to 200x |

| Staking | Fixed and flexible staking |

| Launchpad | Yes |

| Mobile App | Available on iOS and Android |

| Security Features | 2FA, cold storage, SSL encryption, PoR data |

| Regulation | – |

| Customer Support | 24/7 Live chat, email, support center |

| Languages Supported | 15+ |

| Trading Fees | Spot: 0% Futures: 0% maker and 0.001% taker |

| Deposit/Withdrawal Fees | Varies by method |

| Referral Program | Yes |

What We Don’t Like: MEXC Cons Reviewed

No Regulatory Licenses

MEXC operates without regulatory licenses in many areas. For those who value security and legal compliance, this raises concerns. Without the right licenses, the exchange might not be held to the same standards as regulated platforms.

This could put users at risk. They might face problems like weak security, poor consumer protection, and legal issues. Not having regulatory licenses can limit users’ help options during disputes or platform problems.

No KYC Trading

MEXC lets users trade without doing Know Your Customer (KYC) checks. This option might appeal to people who value privacy and seek a fast onboarding process. However, it comes with serious security risks.

Not having KYC verification creates weaknesses. It allows bad actors to misuse the platform for illegal activities like money laundering or terrorist financing. Without user verification, MEXC struggles to implement strong security measures. This can leave honest users vulnerable to fraud or theft.

Skipping KYC checks can lead to missing exclusive features. You may also encounter limits, such as lower withdrawal amounts. These usually apply to verified accounts.

Not Available in the United States

MEXC does not serve users in the United States because of regulatory rules. This limits its user base and leaves out many cryptocurrency traders and enthusiasts.

If you live in the U.S., you won’t be able to access MEXC’s trading pairs, features, or token offerings. These might interest you otherwise. But there are alternatives for U.S. users, like Coinbase or Kraken.

Read: How to use MEXC in the US?

No Margin Trading or Options Market

MEXC does not provide margin trading or an options market. This can be a drawback if you want advanced trading tools. Margin trading lets traders borrow funds to boost their positions. Without it, you have fewer trading strategies. This can limit experienced traders who want to seize opportunities.

Also, the lack of an options market restricts your ability to use complex trading strategies or hedge your positions well. Options trading is key for risk management and taking advantage of market volatility. This makes it valuable for seasoned professionals.

Without these tools, MEXC might not seem as appealing. If you want a trading experience that covers both basic and advanced needs, it may fall short.

Lower Liquidity in New Crypto Tokens

MEXC often lists new tokens, giving you early access to promising projects. This can be a big advantage, but it also brings challenges, especially with liquidity.

Low liquidity can cause several problems for traders:

- Price Slippage: In low-liquidity markets, large buy or sell orders can greatly change asset prices. This makes it hard to execute trades at the prices you want.

- Difficult Price Discovery: With fewer trades and limited market depth, finding a token’s true market value is tough. This situation can make prices vulnerable to manipulation or quick changes.

- Wider Bid-Ask Spreads: Lower liquidity usually results in a wider gap between the highest buy order and the lowest sell order. This means you might pay more when buying or get less when selling.

While early access to new tokens is thrilling, consider these risks before you trade.

Key Features: MEXC Pros Reviewed

Futures Trading

Futures are agreements to buy or sell an asset at a set price on a future date. Here’s a simple breakdown of how they work:

- Traders guess whether a cryptocurrency’s price will go up (“going long”) or down (“going short”).

- In futures trading, you don’t need to own the cryptocurrency. You’re just betting on its price changes.

MEXC is unique because it offers up to 200x leverage on popular cryptocurrencies like BTC, ETH, and over 300 others. This lets traders make bigger trades by borrowing money.

MEXC has two main types of futures contracts:

- Perpetual Futures: These do not expire, so you can hold them as long as you want. Options include Coin-M futures contracts and USDT-M perpetual contracts.

- Quarterly Futures: These contracts expire every three months, giving traders a clear time to close their positions.

Demo Trading For Practice

MEXC’s demo trading feature gives you a virtual account with pretend money. This lets you explore the platform and try trading strategies without risking real funds. You can buy and sell cryptocurrencies. You can also place different orders and test futures trading. Best of all, you can do this in a risk-free environment.

The demo closely resembles the real MEXC platform. It includes real-time market data and price movements. This setup helps you understand how the cryptocurrency market works. You can build key skills like reading charts, spotting trends, and making informed decisions in a realistic setting.

MEXC Review: Earn Passive Income

MEXC Earn offers various features to help you earn passive income from your crypto assets. Here’s a look at its main offerings:

Launchpad

The MEXC Launchpad is a platform for fundraising in emerging cryptocurrency projects. It lets you take part in token sales by staking MEXC’s native token, MX.

Here are the key features of the Launchpad:

- Minimum Staking Period: You usually need to stake your MX tokens for at least 7 days to qualify.

- Allocation Criteria: The number of tokens you receive comes from the size of your staked amount and the length of your staking period.

This platform supports innovative crypto projects. It also gives you early access to new tokens, opening up unique investment opportunities.

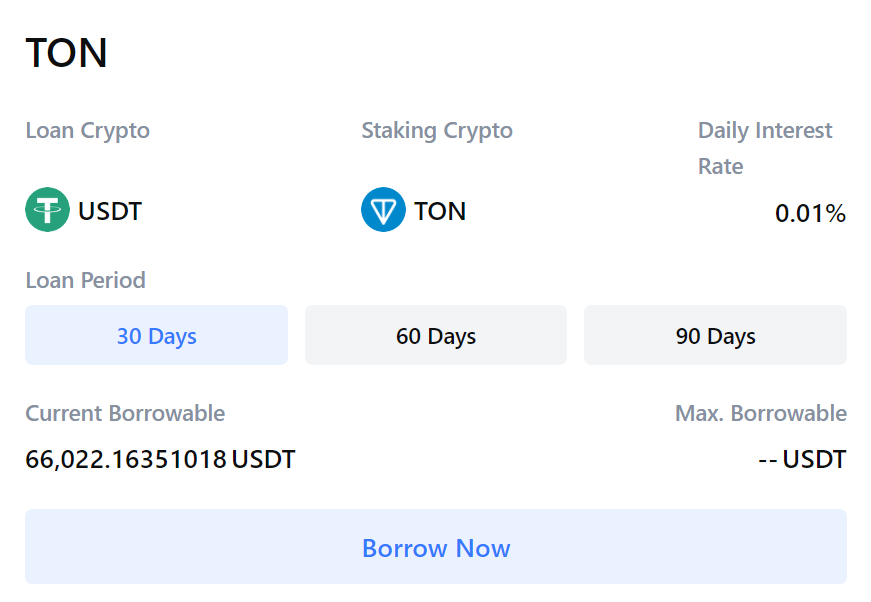

Crypto Loans

MEXC offers a platform for crypto borrowing and lending. Users can leverage their cryptocurrency in various ways:

- Borrowing: You can use your crypto as collateral for loans. The loan-to-value (LTV) ratio varies by asset, usually between 50% and 80%. Interest rates are dynamic and change with market conditions.

- Lending: As a lender, you earn interest by adding liquidity to the loan pool. Loan terms are flexible, ranging from 7 to 180 days, to meet different needs.

Automatic liquidation happens when collateral value drops below the maintenance margin. This helps keep stability. This protects the platform and users from high risks.

MX Zone

MX Zone is a dedicated staking platform for MEXC’s token, MX. Users can lock their tokens for a set time. Longer staking periods provide higher annual percentage yields (APY).

- Earn Competitive APYs: APYs vary with market conditions, ranging from 5% to 20%. This is a solid chance for passive income.

- Daily Rewards: Rewards are given out daily. You can also choose to automatically reinvest them to boost your earnings.

- Join MX Zone: For more than rewards. You also get a say in the MEXC ecosystem. This means you can help shape important decisions.

Savings or Staking

MEXC Savings offers two ways to grow your cryptocurrency: Fixed Savings and Flexible Savings.

- Fixed Savings: You deposit your crypto for a set term, usually 7 to 90 days. Longer terms offer higher annual percentage yields (APYs). Interest rates stay fixed during the term, giving you predictable earnings. If you withdraw early, you’ll lose any accrued interest. Common assets for Fixed Savings include SOL, ADA, and USDT.

- Flexible Savings: This option provides convenience. You can deposit and withdraw funds anytime. Interest is calculated daily and paid out regularly. While APYs are lower than Fixed Savings, they are still competitive at about 10% APR. This makes it great for those seeking liquidity while earning passive income.

MEXC Mastercard

MEXC Mastercard is a crypto debit card. It lets you spend your cryptocurrency easily in real-world transactions. You can use it anywhere Mastercard is accepted, whether online or in stores.

This card supports many cryptocurrencies, like Bitcoin, Ethereum, and USDT. When you buy something, it quickly converts your crypto to the local currency at the current market rate. This ensures convenience and real-time transactions.

MEXC Mastercard has a tiered system based on your MX token holdings. Higher tiers give you more benefits. You get higher spending limits, lower fees, and better cashback rewards. For instance, the basic tier gives 1% cashback, while the top tier can offer up to 5%.

The card allows daily spending up to 3,000 USDT and a monthly limit of 30,000 USDT. Its total capacity is 100,000 USDT. There is a 1% fee for loading funds onto the card.

Security Measures: Is MEXC Safe?

- Two-Factor Authentication (2FA): Adds an extra security layer. You can pick from:

- Anti-Phishing Measures: Lets you set codes to check if emails from MEXC are real, helping to stop phishing attacks.

- Cold Storage: Most funds are kept offline, reducing hacking risks since these assets are not online.

- Allowlisting: This lets you create a list of approved withdrawal addresses. It ensures that funds go only to trusted accounts.

- Withdrawal Management: You can set rules for withdrawals. This gives you more control, like setting spending limits on a credit card.

- Bug Bounty Program: Rewards individuals for spotting and reporting security issues. This encourages experts to improve the platform’s safety.

- Proof of Reserves (PoR): Offers clear on-chain solvency data, allowing you to check MEXC’s financial holdings.

Read in-depth security analysis: Is MEXC safe exchange?

User and Trading Experience

MEXC features a sleek, user-friendly interface. It balances simplicity with advanced functionality. As you explore, you’ll find many cryptocurrencies for trading, from popular coins to hidden gems. The order book is clear, making trades smooth and responsive.

The exchange supports various advanced order types. This caters to those using complex trading strategies. Its charting tools are strong for detailed technical analysis. Depositing or withdrawing funds is easy, with multiple options to fit your needs.

Customer support is prompt and helpful. They quickly address your questions. Beyond trading, MEXC has extra features like staking, futures trading, and a launchpad for new crypto projects.

MEXC Trading Fees

Spot trading fees are 0% for makers and takers. Futures trading fees are 0% for makers and 0.01% for takers. Most cryptocurrencies have no deposit fees. However, withdrawal fees depend on the cryptocurrency.

| Cryptocurrency | Network | Deposit Fee | Withdrawal Fee |

|---|---|---|---|

| MX Token | BEP-20 | Free | 0.1 MX |

| USDT | TRC-20 | Free | 1 USDT |

| ETH | ERC-20 | Free | 0.0008 ETH |

| BTC | Bitcoin network | Free | 0.00005 BTC |

MEXC Exchange offers discounts on trading fees for high-volume traders. You can visit the MEXC Exchange website to learn more about these discounts.

MEXC Deposit and Withdrawal Limits

MEXC provides various transaction and withdrawal options for different users. European traders can sell up to 1,000 EUR in cryptocurrency each day for SEPA transactions. This allows easy access to their funds. For card payments, the platform allows deposits of up to 1,250 USD, 2,000 EUR, or 1,750 GBP per transaction. This gives users flexibility.

Withdrawal limits depend on account verification levels:

- Primary KYC accounts can withdraw up to 80 BTC.

- Advanced KYC accounts can withdraw up to 200 BTC.

- Institutional accounts have the highest limit, allowing up to 400 BTC for withdrawal.

This tiered system enhances security while meeting the needs of both retail and institutional users.

MEXC Alternatives and Comparison

Bitget and KuCoin are the best MEXC alternative crypto exchanges. Here is the quick KuCoin vs MEXC and Bitget vs MEXC Comparison:

Bitget (Best For Crypto Copy Trading)

- Top Features: Spot, Futures with 125x leverage, Trading bots, and Copy trading

- Supported Coins: 850+ including low-cap altcoins

- Trading Fees: 0.1% maker/taker

- Deposit methods: Bank transfer, debit/credit card, P2P marketplace

KuCoin (Best For New Altcoin Trading)

- Top Features: Spot, Futures, Margin, Trading bots, and P2P Trading

- Supported Coins: 700+ including new altcoins

- Trading Fees: 0.1% maker/taker

- Deposit methods: Visa, Mastercard, SEPA, UPI, Faster Payment System (FPS), and 70+ more

How to Use MEXC Crypto Exchange?

Step1: Create an Account and Verify the Identity

To get started on MEXC, visit their website or open the app. Click on “Sign Up.” Enter your email or phone number, then create a strong password. After you sign up, move on to account verification. Go to the “Account” section and select “Verification.” Upload a valid government ID and proof of address. Once you submit these, verification usually takes 1-3 days for approval.

If you prefer, you can use MEXC without KYC. However, skipping verification means less security. It’s best to complete the KYC steps for a safer trading experience.

You can also use our MEXC referral code “2YUvQ” to get a $1000 sign-up bonus and 505 trading fee discount for a lifetime.

Step 2: Deposit Funds to Your MEXC Wallet

After you verify your account, go to the “Assets” section at the top. Then, select “Deposit” and choose the currency you want to add. If you’re depositing cryptocurrency, MEXC will create a unique deposit address for you.

For fiat deposits, visit the “Buy Crypto” section. Choose your preferred payment method, like a bank transfer or credit card. Follow the instructions given to complete your deposit easily.

Step 3: Trade Crypto and Buy Bitcoin

To start trading, click “Markets” at the top of the page. Choose the cryptocurrency you want to trade, like Bitcoin. After selecting it, you’ll see the price chart and order book. Next, find the “Buy” and “Sell” boxes.

You have two ways to place your trade:

- Select “Market” to buy or sell at the current price.

- Choose “Limit” to set your desired price for the trade.

In the “Buy” or “Sell” box, enter how much you want to trade. For Market orders, just input the amount and click the button. For Limit orders, enter both the amount and your chosen price. Double-check everything before clicking “Buy” or “Sell.”

After placing your order, you can review it in the “Open Orders” section below.

Related: How to buy crypto on MEXC?

Step 4: Withdraw Crypto from MEXC

To check your funds, click “Assets” at the top of the page. When you’re ready to withdraw, go to the “Withdraw” section there. Choose the cryptocurrency you want to withdraw. Then, enter the withdrawal address and the amount to send. Review all details carefully before confirming the transaction.

Withdrawing Bitcoin or other assets might have gas fees. Keep that in mind when you decide.

Final Verdict

In this MEXC review, the platform proves to be a reliable choice for crypto fans. It offers a good blend of trading features, low fees, and many cryptocurrencies. It might not meet all needs, especially for those focused on regulations or advanced tools. Still, it works well for many types of traders. Whether you’re new to crypto or looking to expand your trading strategies, MEXC is worth a look.

FAQs on MEXC Exchange Review

What is MEXC?

MEXC Global, founded in 2018, is a flexible cryptocurrency exchange. It meets many trading needs. The platform supports various digital assets, including cryptocurrencies, futures, and margin trading. It has gained a reputation for low fees and high liquidity, which attract many traders.

MEXC also offers features to improve user experience. These include staking, lending options, and a launchpad for new projects. MEXC is a major player in the global crypto market. It operates in over 200 countries and serves more than 6 million users.

What cryptocurrencies are available on MEXC?

MEXC stands out with its wide selection of over 2,200 cryptocurrencies for trading. This includes popular assets like Bitcoin, Ethereum, and Tether, as well as many altcoins and new tokens. A key strength of MEXC is its quick listing of emerging projects. It’s usually one of the first places to access promising cryptocurrencies that are still growing. MEXC is a great platform for traders.

Does MEXC support copy trading?

Yes, MEXC offers copy trading with its social trading feature. Users can follow and automatically copy the trades of successful traders. This is great for beginners. They can learn from experts and possibly profit from their strategies. Copy trading works for both **spot** and **futures markets**, giving traders flexibility based on their preferences.

Is MEXC trustworthy?

Yes, MEXC has built a strong reputation as a reliable cryptocurrency exchange since it started in 2018. It has strong security features. These include multi-signature wallets and regular security audits. They help keep user assets and data safe. Notably, the platform has not faced any major security breaches, which boosts its reliability.

MEXC is also recognized for its transparency. It keeps users updated and communicates clearly about its operations. However, a key drawback is the absence of a major regulatory license. This may worry users who prefer a fully regulated platform. Still, MEXC’s strong history and focus on security make it a favored choice among traders.

Is MEXC better than Binance?

MEXC excels in various areas. It is known for its wider selection of altcoins and the ability to quickly list new tokens. This makes it a great option for traders looking for lesser-known assets. Plus, MEXC offers zero-fee trading, which helps reduce costs for frequent traders.

In contrast, Binance is recognized for its higher liquidity. This feature ensures smoother and more stable trading, especially for large transactions. Binance also has a broader range of services. These include advanced trading tools, extensive staking options, and educational resources. However, Binance charges trading fees starting at 0.1%, which could be a concern for budget-minded users.

Both exchanges serve different needs. The best choice depends on your trading goals and preferences.

Is MEXC legal in the USA?

MEXC’s legal status in the United States is complex. The exchange does not have a license to operate in the USA. Its terms of service state that US residents cannot use the platform. Still, some US users may access MEXC using VPNs. However, this can violate MEXC’s terms and local laws. Users may face consequences for doing this.

Can I withdraw from MEXC to my bank account?

No, MEXC does not allow direct bank account withdrawals. Our review shows you can only withdraw cryptocurrencies to external wallets. Users can convert crypto to fiat by moving their assets to a platform that allows fiat withdrawals. They can also use a peer-to-peer exchange. MEXC mainly focuses on crypto-to-crypto transactions.

Who is MEXC best for?

MEXC is perfect for crypto traders. It offers many altcoins and fast token listings. It serves both beginners and experienced traders with features like spot trading, futures, and staking. The platform draws in people eager to invest early in new projects. This is especially true for those who can handle the risks of lesser-known cryptocurrencies. MEXC also suits traders who prefer not to do KYC verification, giving them more flexibility.

Is MEXC mobile app good for beginners?

The MEXC mobile app is made for beginners. It offers a simple and functional experience. Its clean interface and easy navigation help users explore key features. The app also has educational resources to teach users about trading and cryptocurrency.

What payment methods does MEXC offer?

MEXC offers several payment options. This makes it easy for users to deposit funds. You can use bank transfers, credit or debit cards, and third-party payment processors like Banxa, MoonPay, and Mercuryo. The platform also enables peer-to-peer (P2P) trading. Users can make fiat-to-crypto transactions directly with each other. Payment methods can change based on where you are and what cryptocurrency you want to buy.